MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED FEBRUARY 13, 2026

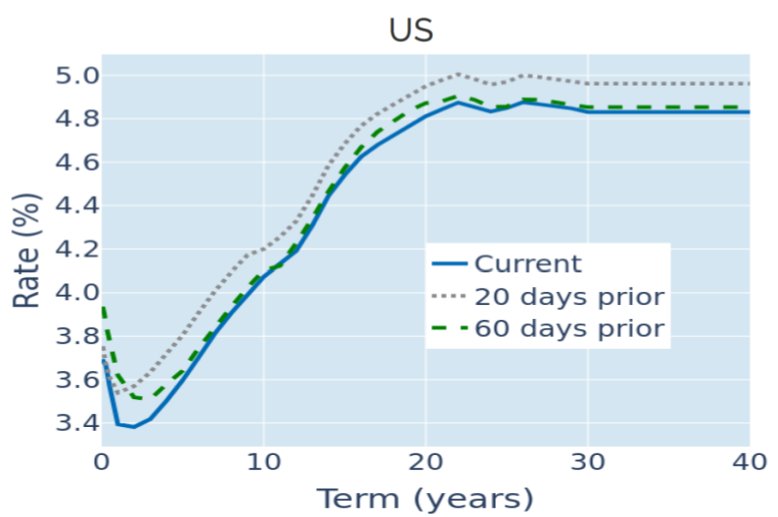

Slower inflation and safe-haven buying depress Treasury yields

A combination of lower-than-expected inflation data and safe-haven buying depressed US Treasury yields across all maturities in the week ending February 13, 2026.

The Bureau of Labor Statistics reported on Friday that American headline consumer prices grew by 2.4% in the 12 months to January—down from 2.7% the month before and slower than the 2.5% predicted by analysts. In response, short-term interest rate traders lowered their monetary policy expectations, with the projected average federal funds rate for December 2026 ending the week 7 basis points lower at 3.03%. The move was propagated along the yield curve, pushing the 2-year point down 0.1% to its lowest level since September 2022.

The demand for government debt was further boosted by the biggest weekly selloff in the US stock market in twelve weeks amid ongoing fears that AI could threaten traditional software and wealth management businesses. Wednesday’s bumper labor market data did little to curb the appetite for safe assets, despite showing the biggest monthly jobs gain in more than two years. The slightly delayed non-farm payrolls report noted 130,000 new positions created in January, up from a downwardly revised 48,000 the month before and almost double the consensus forecast of 70,000.

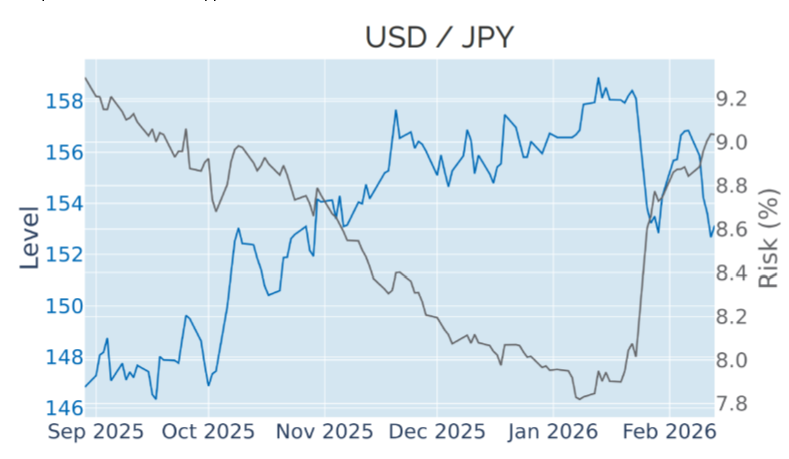

Lower rates weigh on the dollar, boosting the yen

Last week’s drop in Treasury yields also weighed on the dollar, which depreciated by an average 0.7% against a basket of major trading partners. The move reflected an increasingly bearish sentiment toward the greenback, driven by lingering political uncertainty in the United States and a reassessment of the dollar’s safe haven appeal. The yen was the biggest beneficiary among the G10 currencies, gaining 2.7% against its American rival over the first four days of the week to its strongest level since the end of October. Prime Minister Sanae Takaichi’s decisive election victory on the preceding weekend significantly reduced political uncertainty, giving the Liberal Democratic Party a historic two-thirds majority in the lower house and with it the power to override the upper chamber.

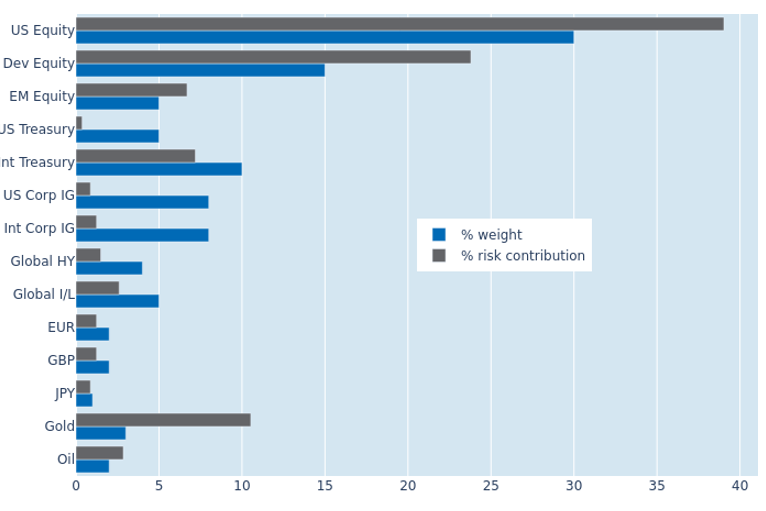

Renewed US tech selloff raises portfolio risk

The renewed sell-off in US software stocks raised the predicted short-term risk of the Axioma global multi-asset class model portfolio to 8.1% as of Friday, February 13, 2026, up from 7.3% a week earlier. US and developed non-US equities bore the brunt of the risk increase, with their shares of total portfolio volatility expanding by 4% and 1.9%, respectively. At the other end of the spectrum, gold saw its percentage risk contribution fall for the first time in eight weeks, as the precious metal climbed back above the $5,000 mark. Its less inverse relationship with the US dollar also meant that most non-USD fixed income securities contributed less to overall risk than in previous weeks. US Treasury bonds offered the greatest diversification benefits, neither adding to nor subtracting from total portfolio volatility, as their prices remained decoupled from the stock markets and FX rates.

You may also like