EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED MAY 9, 2025

Axioma Risk Monitor: US market holds steady amid mixed signals; Chinese stocks rally on government stimulus and trade-talk optimism; Emerging Markets outpace Developed in country risk climb

US market holds steady amid mixed signals

The US market remained relatively steady last week, influenced by a mix of policy decisions, trade negotiations, and economic data releases, which led to muted market movements. The STOXX US index closed the week down 0.4% after two consecutive weeks of strong gains.

The Federal Reserve’s Federal Open Market Committee (FOMC) kept its key interest rate unchanged for the third consecutive meeting, citing increased uncertainty about the economic outlook and risks of higher unemployment and inflation. This "wait-and-see" approach did not significantly impact the market, as investors had largely anticipated the decision.

Midweek, renewed optimism for trade talks with China and other US key partners helped lift market sentiment, partially offsetting concerns about the economic impact of earlier tariff announcements. The US-UK trade deal was seen as a positive signal for broader trade relations.

Regarding economic news, the US Services sector continued to expand, albeit at a slower pace compared to previous months. Meanwhile, jobless claims decreased, indicating ongoing strength in the labor market.

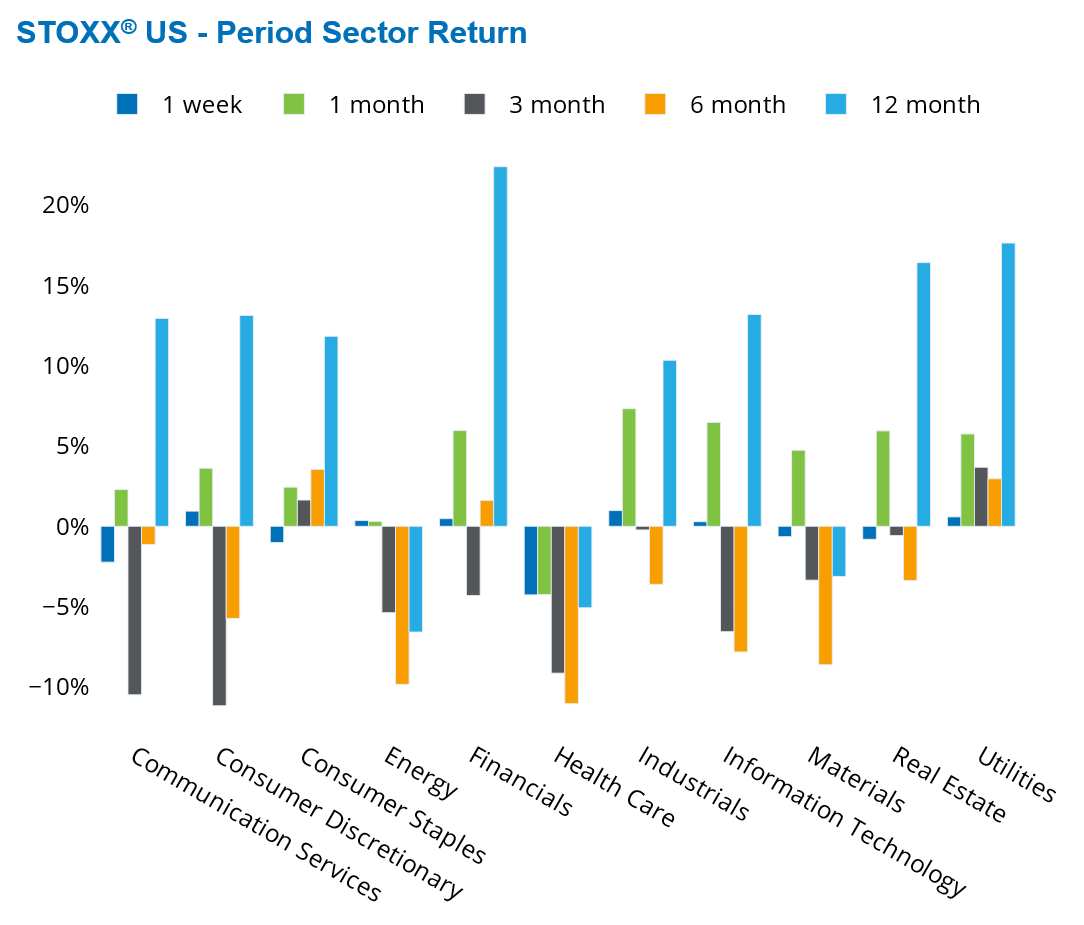

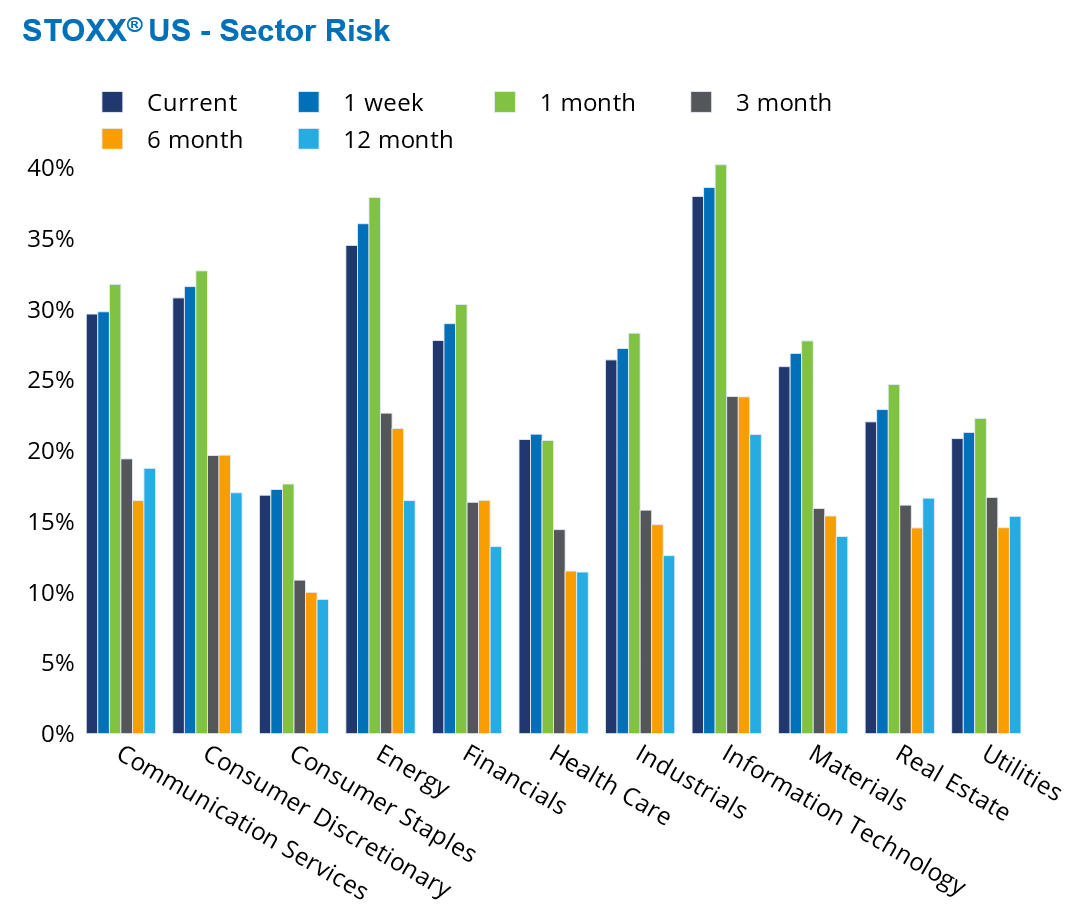

Several sectors, including Consumer Discretionary, Financials, Industrials, and Utilities, managed to achieve modest weekly gains. The largest US sector, Information Technology, remained flat, while Health Care experienced the largest weekly loss due to ongoing uncertainty regarding health care policy. At the same time, short-horizon forecasted risk declined for all US sectors over the past five business days.

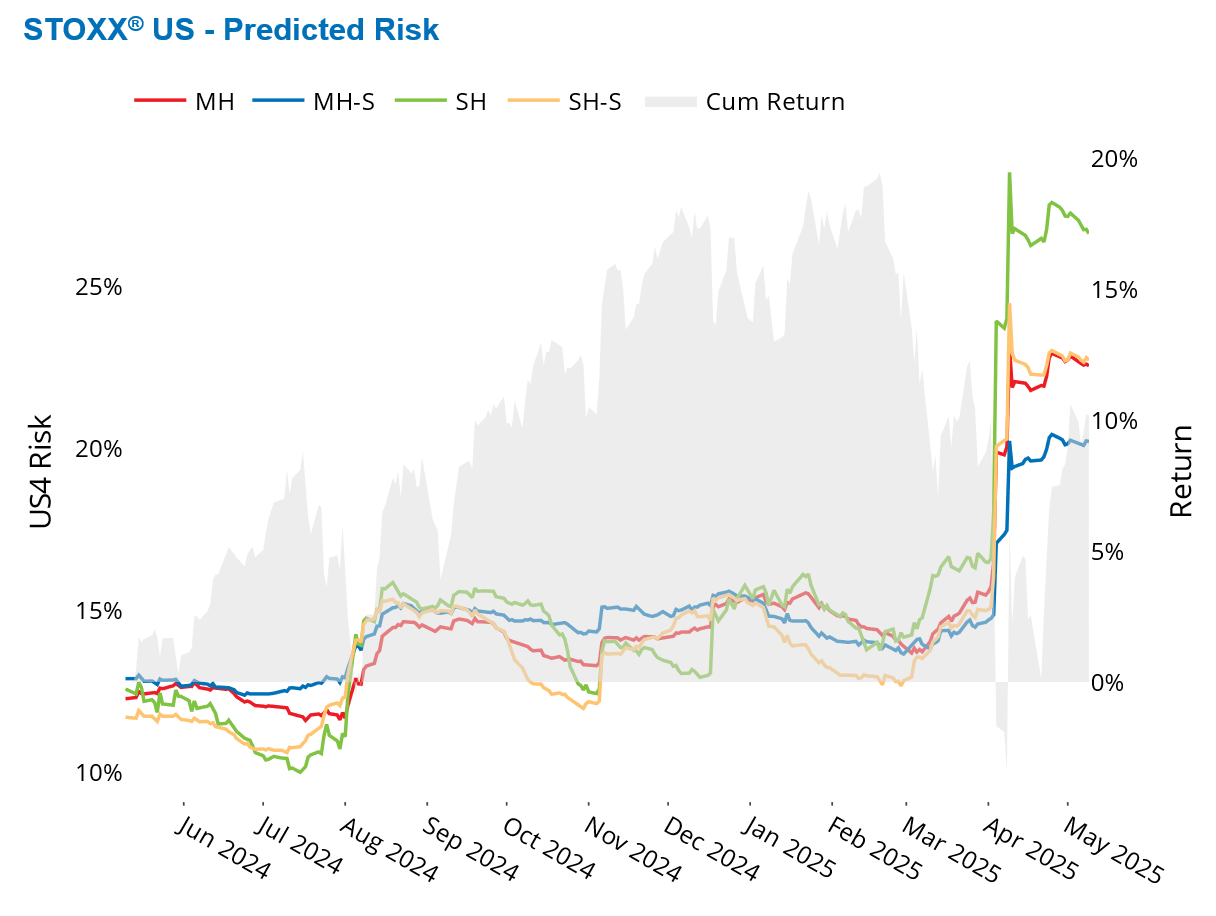

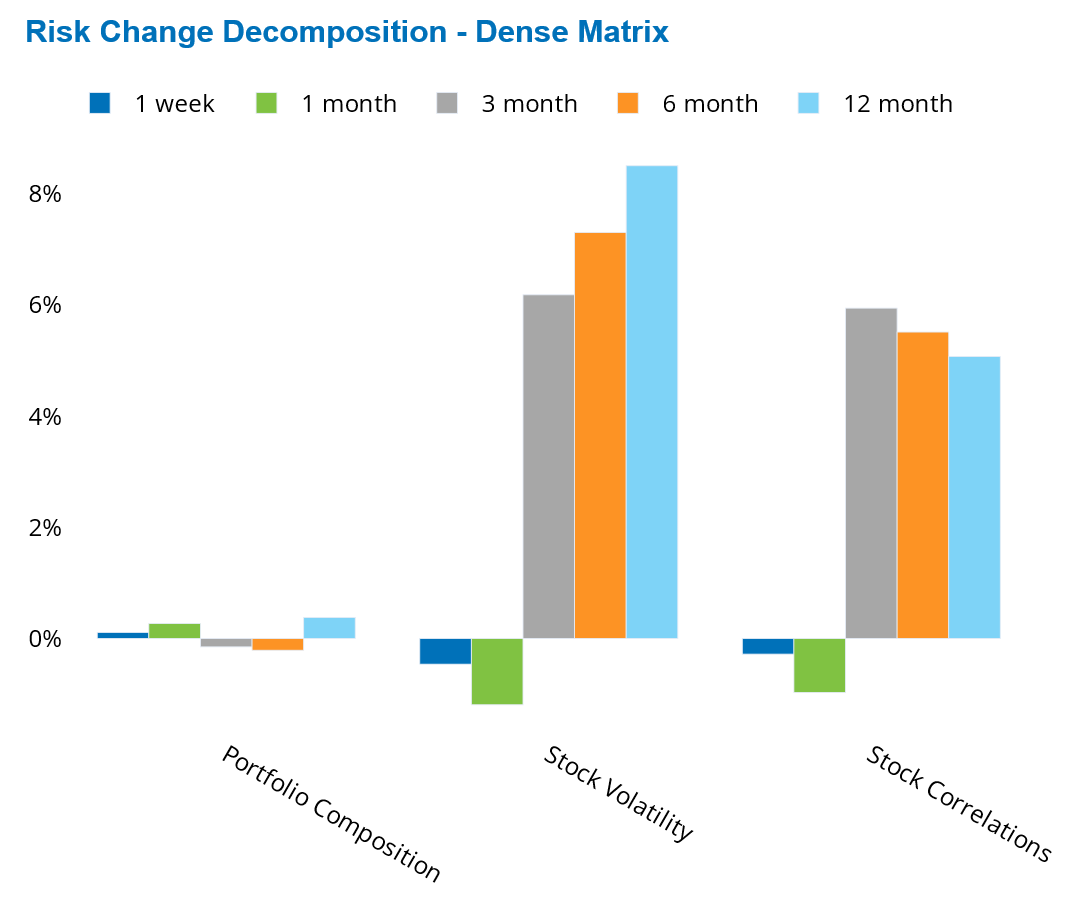

Volatility and correlations in US stocks both declined slightly, resulting in a decrease in the total risk of the STOXX US index by about 60 basis points, as measured by the Axioma US4 fundamental short-horizon risk model. Last week’s decline positioned the US as the second-riskiest region after Japan, among the major geographies tracked by the Equity Risk Monitors.

See graphs from the STOXX US Equity Risk Monitor as of May 9, 2025:

Chinese stocks rally on government stimulus and trade-talk optimism

Chinese stocks rose during the short trading week last week, driven by the Chinese government stimulus measures. The People’s Bank of China (PBoC) announced a 50-basis-point cut in the reserve requirement ratio (RRR) and a 10-basis-point reduction in the seven-day repurchase rate to 1.4%. The reduction in the RRR is expected to inject about 1 trillion yuan (approximately $138 billion) into the financial system, while the decrease in the repo rate aims to make borrowing cheaper and encourage more lending within the economy.

Additionally, the PBoC introduced low-cost relending facilities to support the purchase of technology-related bonds and investments in elder care and consumption services. Existing support for agriculture and small businesses will also be enhanced. The central bank is reducing mortgage expenses for some buyers and expanding a pilot program that allows insurance firms to invest more in the stock market.

These measures boosted investor confidence, signaling Beijing’s intent to counteract economic pressures from US tariffs and a projected growth slowdown. Optimism surrounding upcoming US-China trade talks, scheduled for May 9–12 in Switzerland, also contributed to the rally.

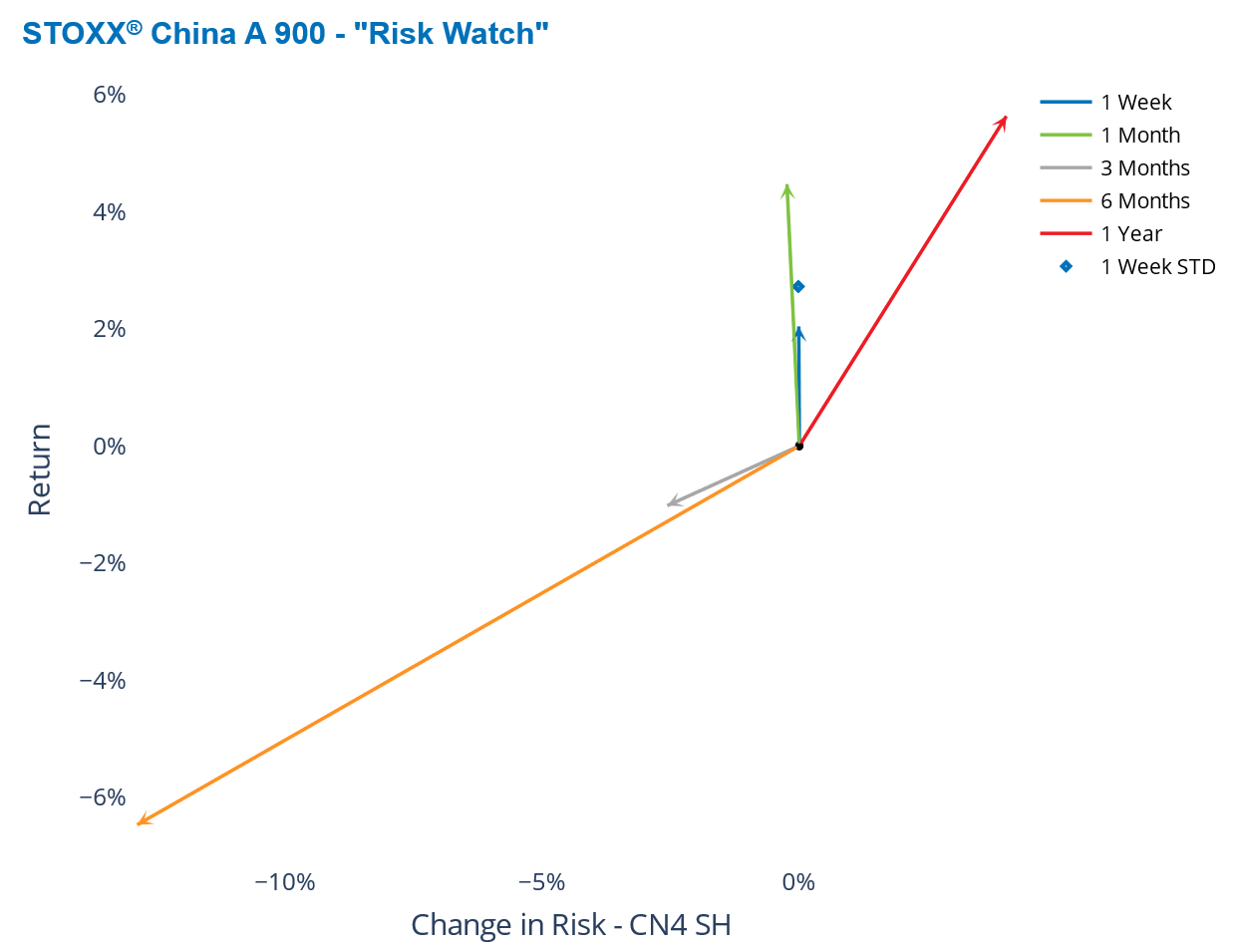

The STOXX China A 900 index posted a weekly gain of 2% over the past four business days, as the Chinese market was closed between May 1 and May 5 in observance of Labor Day. This gain remained within one standard deviation of expectations at the beginning of the period. All sectors in the Chinese index were up, with Financials leading the gains.

Despite last week’s advancement, the STOXX China A 900 index remained in negative territory, recording a year-to-date loss of 1%, yet outperforming the STOXX US index by more than 200 basis points. At the same time, the risk of the Chinese market continued to decline slightly, with China now being nearly 30% less risky than the US.

See graphs from the STOXX China A 900 Equity Risk Monitor as of May 9, 2025:

Emerging Markets outpace Developed in country risk climb

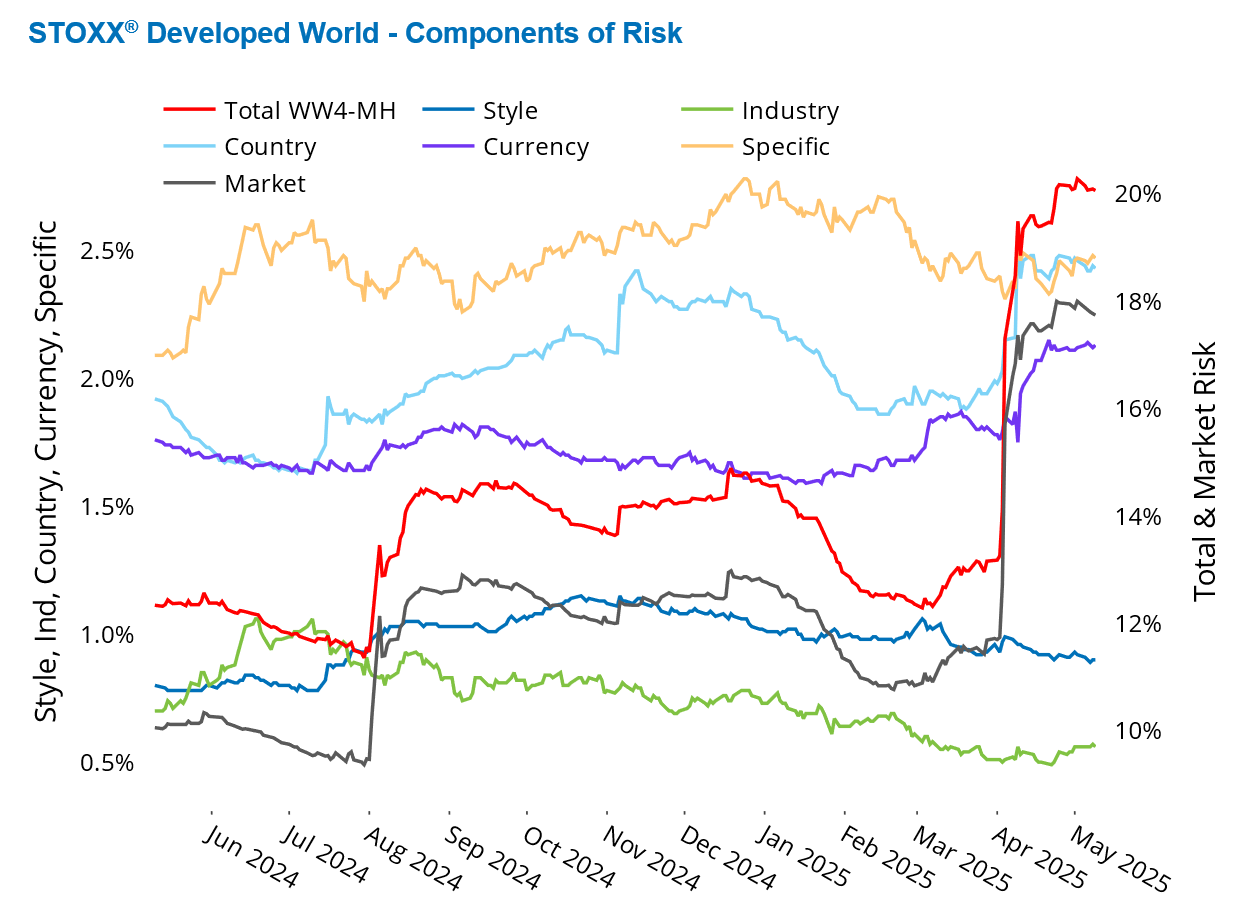

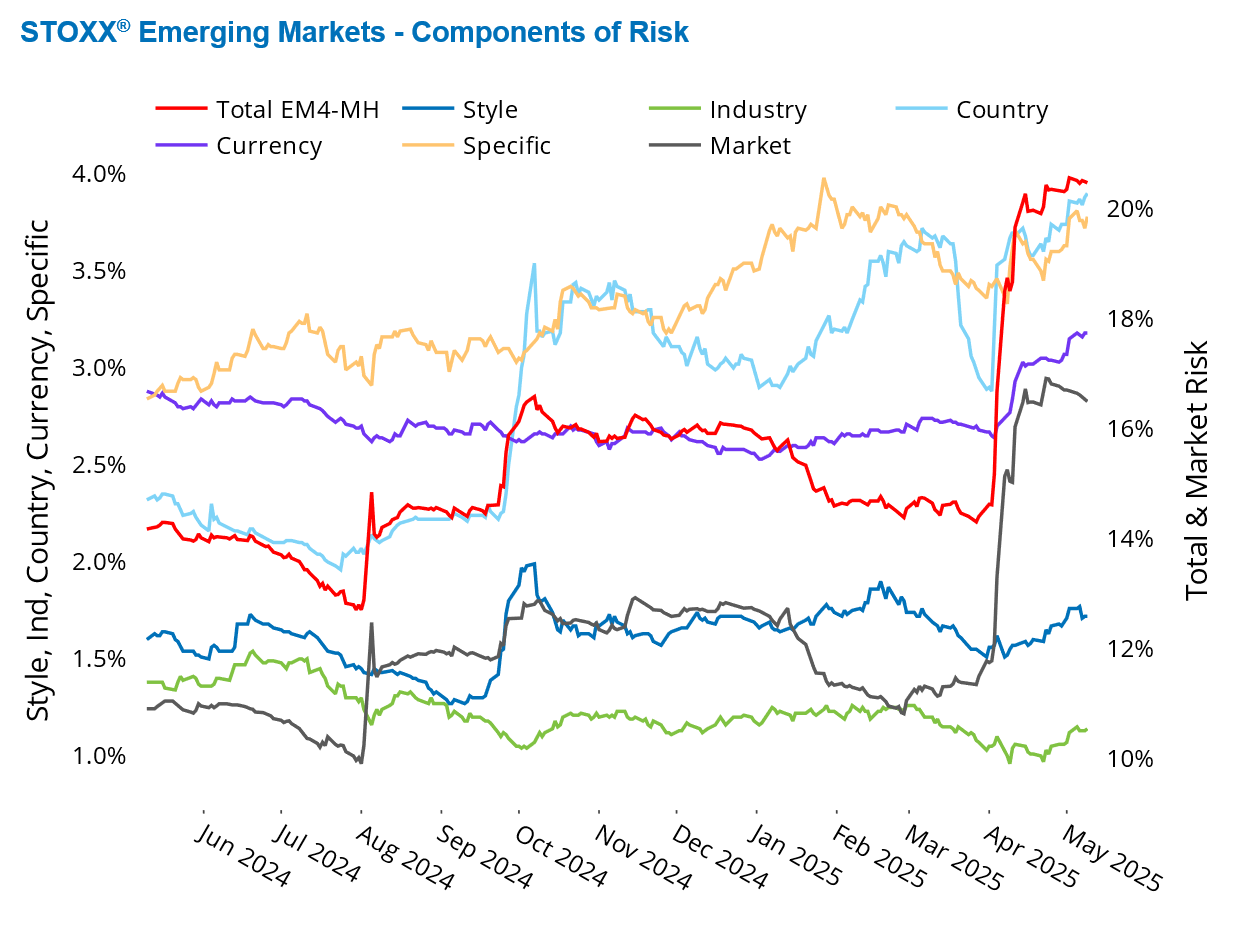

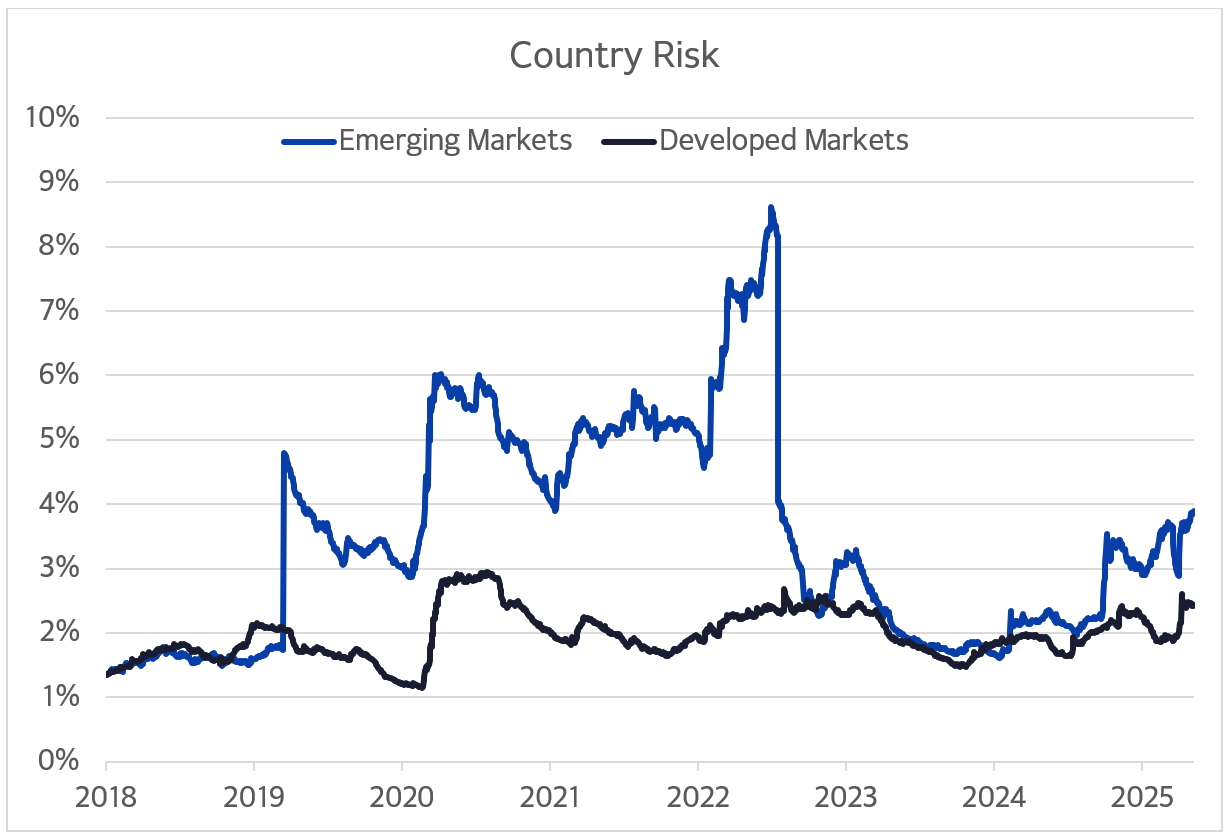

Country risk remained elevated despite a decline in total equity risk for both developed and emerging markets. Following Liberation Day, country risk surged to levels not seen in three years for both STOXX Developed World and STOXX Emerging Markets, as measured by the Axioma Developed and Emerging Markets fundamental medium-horizon models.

Last week, country risk for the STOXX Developed World remained flat (at 2.4%) but stayed above its 2% seven-year median and just below the record peak for this period. In contrast, country risk for STOXX Emerging Markets continued to climb, approaching 4%, surpassing its long-term median of 3%, yet still well below the July 2022 peak of over 8%.

While aggregate country risk was similar for STOXX Developed World and STOXX Emerging Markets indices last October, emerging market country risk has since risen faster and now significantly exceeds that of developed markets. Among developed countries, Singapore, Denmark, and Japan saw the largest increases in extra-market risk. Among emerging countries, Taiwan, South Africa, Mexico, and China experienced the most significant increases.

The high aggregate country risk in both developed and emerging countries signals the need for global investors to reassess their exposures, adjust risk-return expectations, and implement robust risk management strategies.

See chart from the STOXX Developed World Equity Risk Monitor as of May 9, 2025:

See chart from the STOXX Emerging Markets Equity Risk Monitor as of May 9, 2025:

The following chart is not in the Equity Risk Monitors but is available on request:

You may also like

.png%3Fh%3D1080%26iar%3D0%26w%3D1920&w=3840&q=75)