MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 9, 2025

Fed holds rates steady amid increasing concerns over tariff impact

American stocks and bonds underperformed their European counterparts in the week ending May 9, 2025, as the Federal Reserve held its policy target steady for the third meeting in a row, citing increased risks of higher unemployment and inflation. In the press conference following the decision on Wednesday, Chair Powell noted that the tariff’s announced by the Trump administration had been “significantly larger than anticipated” and that “their effects on the economy remain highly uncertain.” If sustained at their current level, those tariffs would be “likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment.” This means that the central bank could find itself in a scenario, in which its “dual-mandate goals [of price stability and full employment] are in tension.”

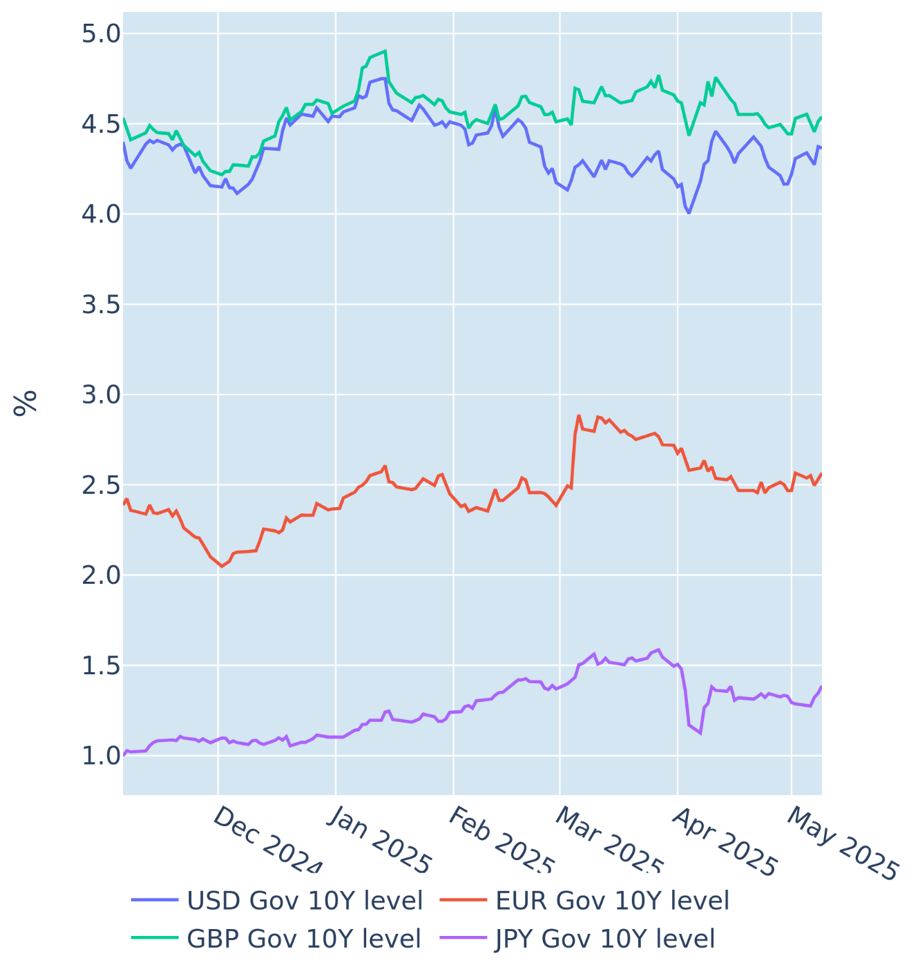

In response, short-term interest-rate futures markets now no longer expect the FOMC to ease monetary at its next meeting on June 18, lowering the implied probability of a rate cut to less than 10%, compared with a two-in-three only two weeks earlier. The projected average effective federal funds rate for December also climbed by another 0.11% to 3.72%, just 61 basis points lower than the current level. This was further propagated along the Treasury curve, where yields rose by an average of 5 basis points across all maturities.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated May 9, 2025) for further details.

Drops in asset-class volatilities reduce portfolio risk

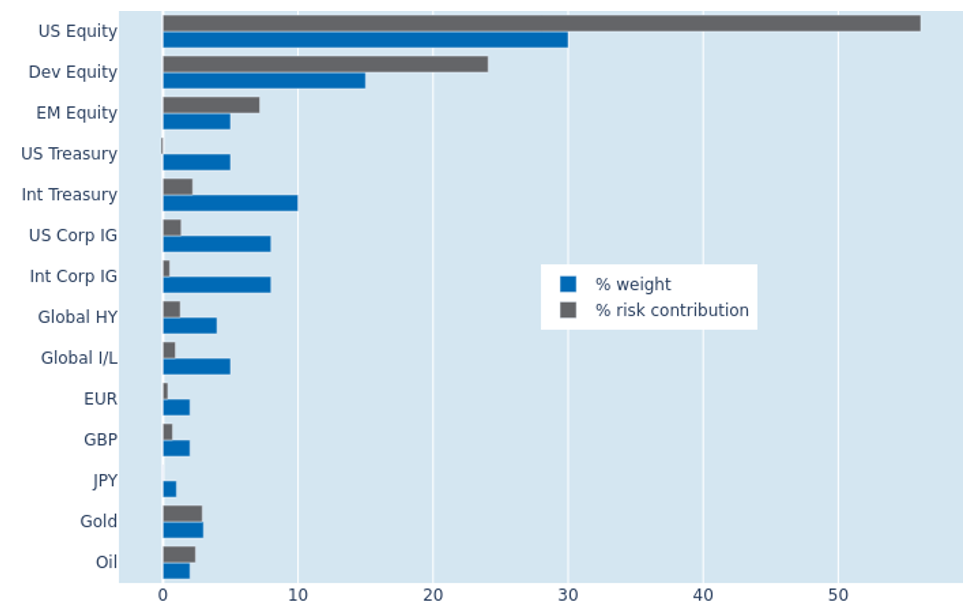

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by another two percentage points to 14.1% as of Friday, May 9, 2025. The reduction was predominantly due to further drops in FX rate, stock market, and commodity price volatilities. Cross-asset class correlations, on the other hand, remained mostly stable, leaving the portfolio risk profile largely unchanged, with global equities accounting for 87.4% of overall volatility. US Treasury bonds remained uncoupled from share prices, neither adding to nor subtracted from total risk, while the risk contribution of their international counterparts was dominated by exchange rate fluctuations and the perceived co-movement with their corresponding stock markets.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 9, 2025) for further details.

You may also like

.png%3Fh%3D1080%26iar%3D0%26w%3D1920&w=3840&q=75)