Alternative Investments

Release 25.07

Improved TVPI/lifetime adjustment

Improved TVPI/lifetime adjustment

The convergence of a fund’s forecasted TVPIs and lifetimes towards its TVPI and lifetime on maturity is controlled by an internal age mechanism. The feature assures that, on inception date, the forecast for the fund is consistent with the forecast model’s projections.

Benefits

- No confusion over forecast model’s projection and what is forecasted for a fund at inception date

- Increased confidence that forecasts are consistent over time and converge towards the fund’s outcome at maturity

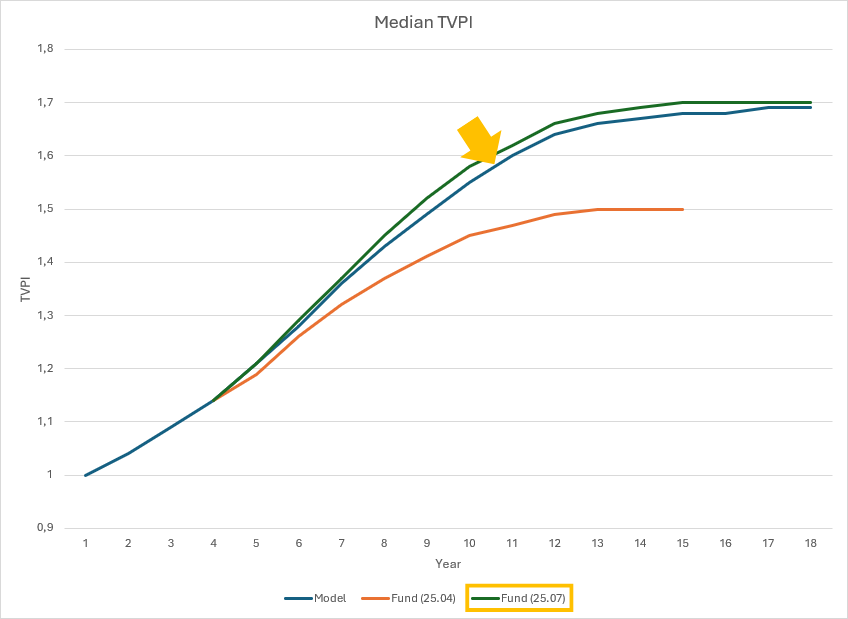

The chart shows median TVPI development for a draft forecast model. ‘Fund (25.04)’ shows the development in version 25.04 of a fund from the end of year 4. At the end of year 4, the fund has the same total contributed, total distributed, and NAV as the forecast model projected on average over the same time horizon. ‘Fund (25.07)’ shows that the new release produces better results for this case.

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Alternatives Strategy Analysis

Browse the Release Portal

Release 25.04 Alternative Investments

Adjusting contributions based on the fund’s current state

Contribution rates can be set manually (in the forecast model) or automatically derived from the latest private market data. Forecasted contribution rates automatically adjust to align with the fund’s real contribution rates and investment period.

Benefits

- More reliable and precise forecasting

- Increased confidence that results reflect the latest available information

Over time, forecasts based on the average contribution rates derived from private market data are corrected, giving increasing weight to the fund’s specific development.

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Alternatives Strategy Analysis

Options for distribution rate schedule

Distribution rates can be set manually (in the forecast model) or automatically derived from the latest private market data. These settings can be in the form of the bow factor or as annual distribution rates. The bow factor is one of the Takahashi-Alexander Model’s standard parameters. Distribution rates, as also promoted by MSCI, will give a more realistic distribution curve aligned with the market compared to the bow factor. Forecasted distribution rates are adjusted to align with the fund’s predicted lifetime.

Benefits

- More reliable and precise forecasting

- Increased confidence that results reflect the latest available information

Distribution rates can be set in the forecast model by defining bow factors or, alternatively, a distribution rate schedule. Another, and often preferred, option is calculating rates based on private market data.

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Alternatives Strategy Analysis

Release 25.01 - Alternative Investments

Integrating short-term forecasts

ASTRA produces forecasts that enable users to explore the ranges of their portfolio’s development and outcomes. These are model-based forecasts and, therefore, come with uncertainty. However, short-term cashflows already entered into SCD can be considered as fact or at least highly reliable.

ASTRA combines model-generated fund-level cashflow forecasts with these entered and nearly certain cashflows to improve short-term forecasting. Cashflows forecasted by the model (using Takahashi-Alexander and stochastic methods) and the NAV for the affected periods are adjusted accordingly. Users can configure whether these short-term cashflows are included in the forecasts or not, and can identify them in the results.

Benefits

- More reliable and, in the near term, more precise forecasting

- Enhances treasury management capabilities

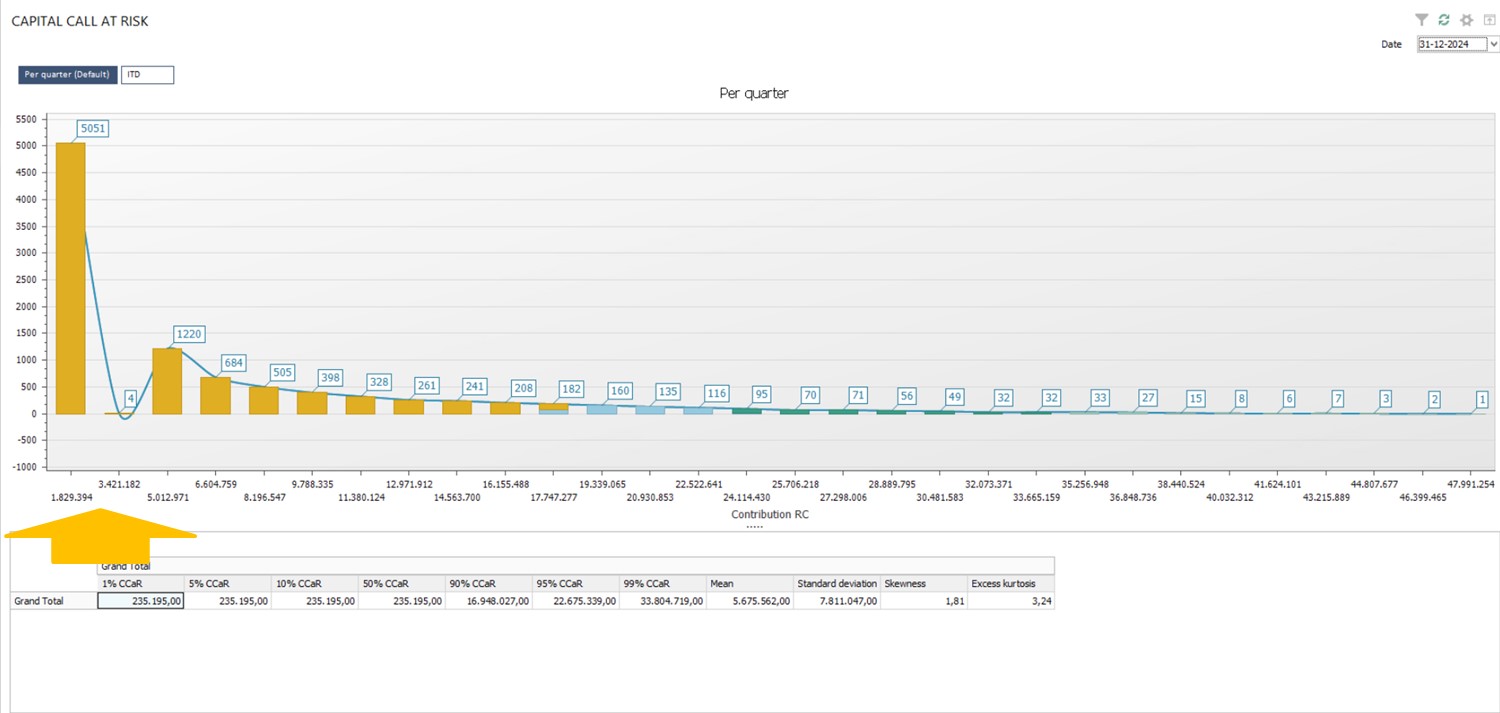

Without reflecting the short-term cashflows, ASTRA generates this histogram for the Capital-Call-at-Risk analysis:

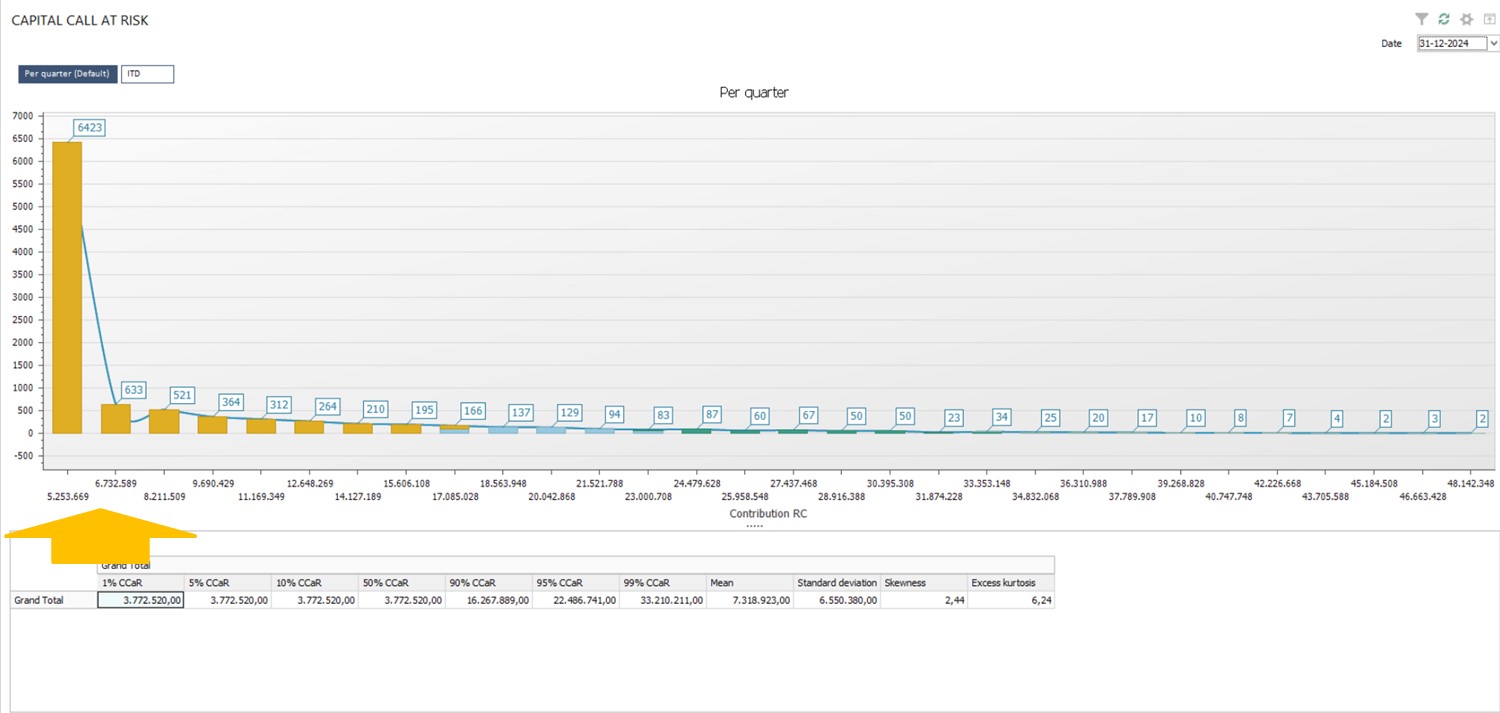

The impact of incorporating short-term cashflows can be seen in this histogram for the Capital-Call-at-Risk analysis and the same portfolio of funds:

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Cash-flow Forecasting for Illiquid Alternative Investment Funds

Release 24.10 - Alternative Investments

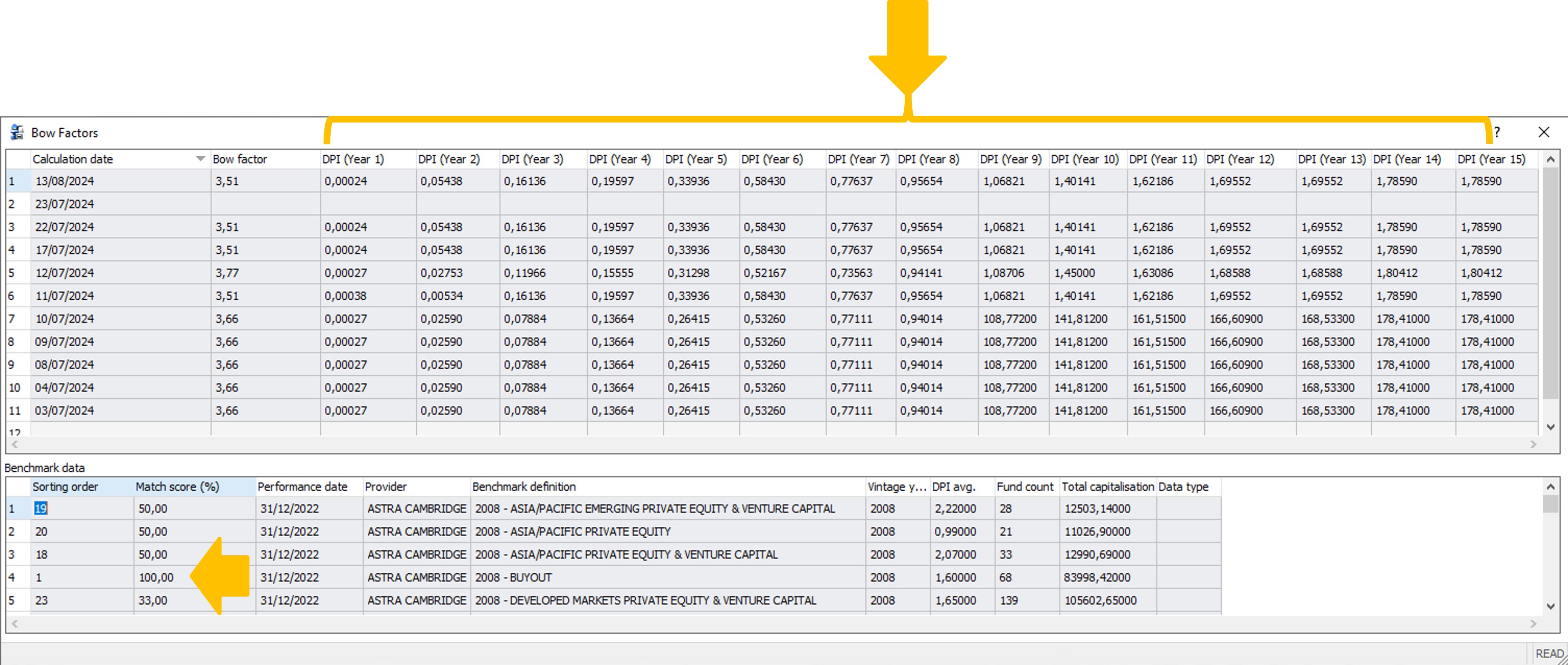

Up-to-date contribution rates and bow factors based on private market data

Within ASTRA, several forecast models provide strategy-specific parameters for the Takahashi-Alexander Model. For the critical parameters of the fund’s annual contribution rates and its bow factor, ASTRA has so far relied on historical expert opinion and research papers. Users perceive this to be too judgmental and often not in line with recent market developments. This feature offers an improved solution by accessing private market data and automatically calculating up-to-date contribution rates and bow factors.

The forecast model has a new setting parameter to cap contributions in the divestment period to address the edge case where too little capital was called during the investment period and to stop the model from projecting unrealistically high distributions to investors. The resulting contribution rates are stored together with information about the used benchmark data. The calculation can be run as a batch task (Alternative Investment – Calculate Contribution Rates).

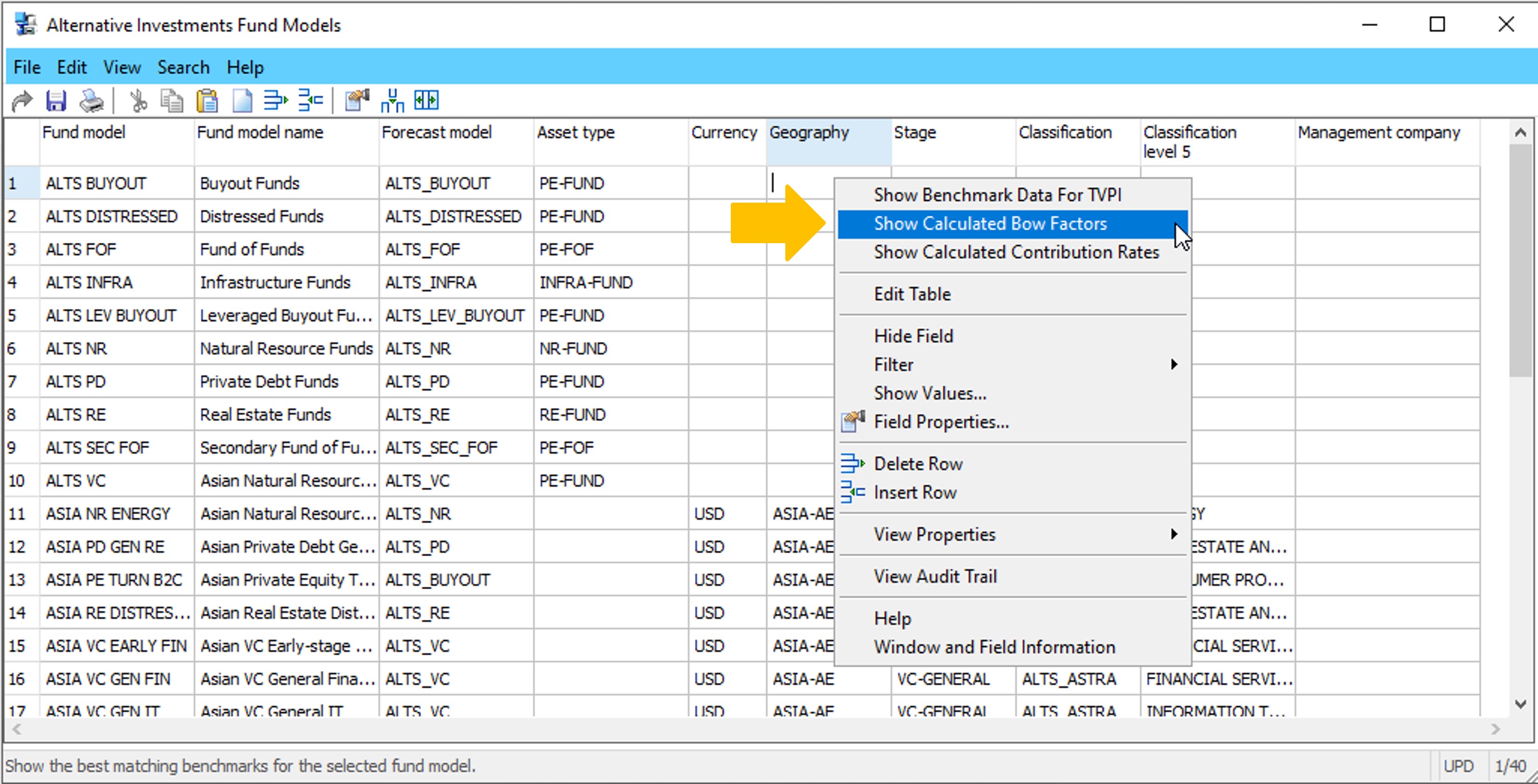

Also, the resulting bow factor is stored together with information about the used benchmark data. The calculation can be run as a batch task (Alternative Investment – Calculate Bow Factors). The solution solves the optimization problem to find the bow factor that minimizes the distance between the Takahashi-Alexander Model and the private market data DPIs.

Benefits

- Ability to leverage the private market data users have available

- Ability to work with up-to-date and granular data (in line with what private market databases provide), more specific to the user’s investment strategies

- Increased detail when analyzing different investment strategies

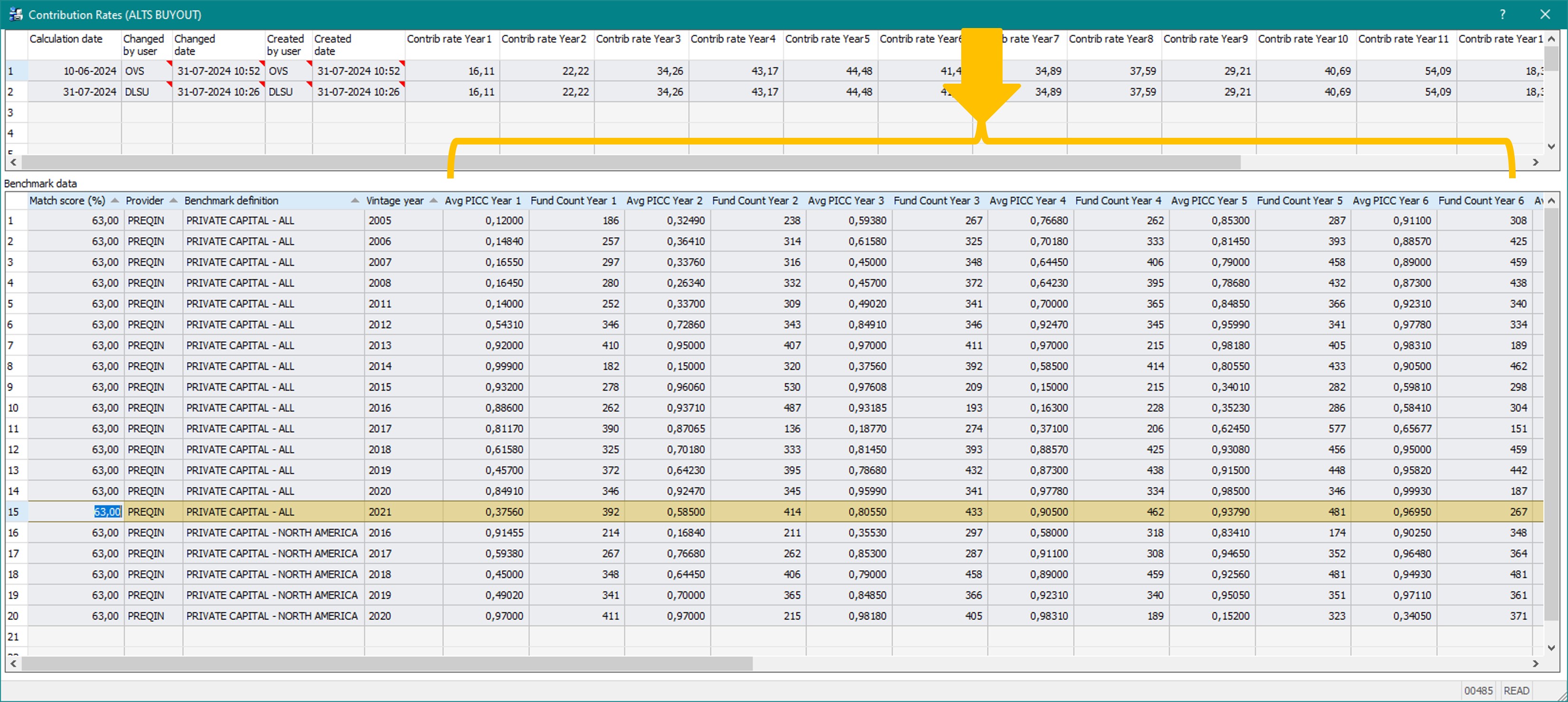

The private market data provider’s PICC (Paid-In to Capital Committed) statistics per strategy forms the basis for extracting and averaging the yearly contribution rates:

This example shows how for the strategy PRIVATE CAPITAL – ALL and for the vintage year peer group population the data for various fund ages (year 1, year 2, etc.) are used to collect the PICC data.

The private market data provider’s DPIs (Distributed-to-Paid) statistics per strategy forms the basis for determining the fund’s bow factor:

After the calculation, the best fitting bow factor can be looked up:

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Cash-flow Forecasting for Illiquid Alternative Investment Funds

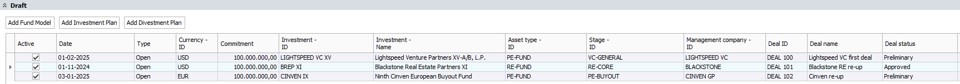

Import/update of drafts from deal pipeline maintained in external system

ASTRA models future commitments to funds in the draft section. Front-office managers manage the pipeline investments in deal-flow systems like DealCloud, effectively leading to redundant input work. To be able to include the pipeline of planned commitments in ASTRA projections and to avoid duplications of manually maintained data, ASTRA now supports the import/update of deals into SimCorp Dimension.

Benefits

- Significantly reduced manual effort and operational risk

- Improved front-office manager support

Pipeline data is Imported into a new screen, External Portfolio Strategy Drafts, and automatically assigned best matching forecast model. Deal information (ID, name, and status) are made available in the Portfolio Strategy:

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Cash-flow Forecasting for Illiquid Alternative Investment Funds

Release 24.07 - Alternative Investments

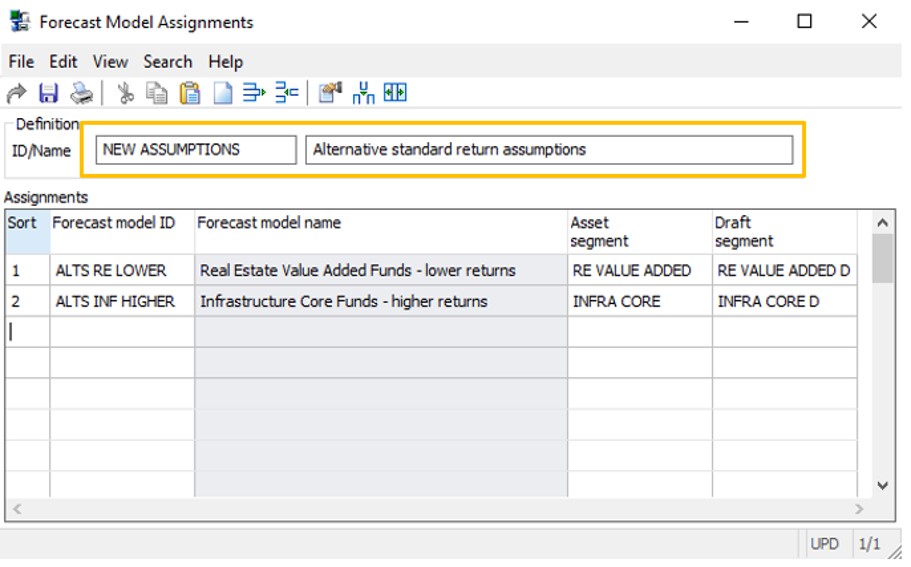

Switching between forecast models

This functionality allows investors in illiquid alternative assets to flexibly use different sets of assumptions for forecast models.

So far users of the Alternatives Strategy Analysis could only work with one set of parameterizations for the forecast models (deterministic Takahashi-Alexander Model and the stochastic model). If parameters needed to be changed, for example to test other assumptions or because of a changed market environment, users could only overwrite the parameters.

For many investors working with different forecast models is an important use case, that allows having an organization-wide approved standard model while giving individual analysts the ability to work with their specific assumptions or to assess the impact variations of parameters (for example related to contribution rates, bow factor, or yield) on the forecasts.

Benefits

- Ability to override forecast models for all or a subset of investments without losing the original parameter settings

- Ability to switch between different sets of forecast models for deterministic and stochastic forecasts

- Additional flexibility when analyzing different investment strategies

- Ability to compare the results of different sets of assumptions

- Prepare for a future back-testing functionality

Images

Users can change their assumptions and assign various versions of these assumptions to a forecast model:

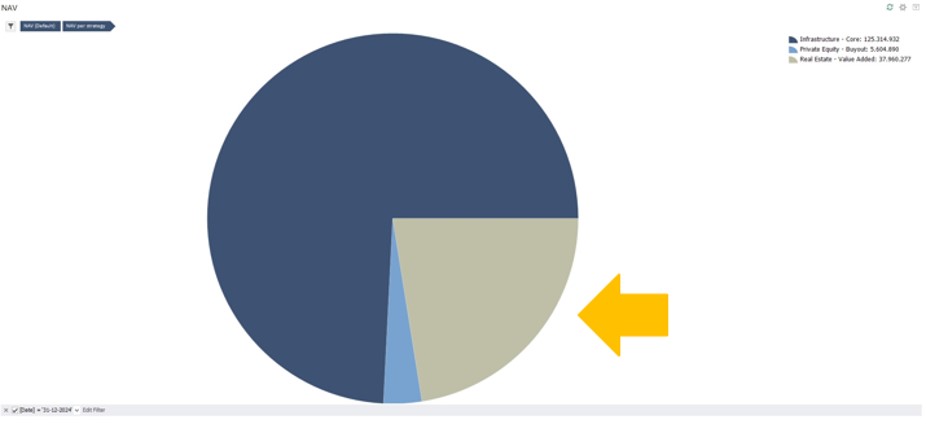

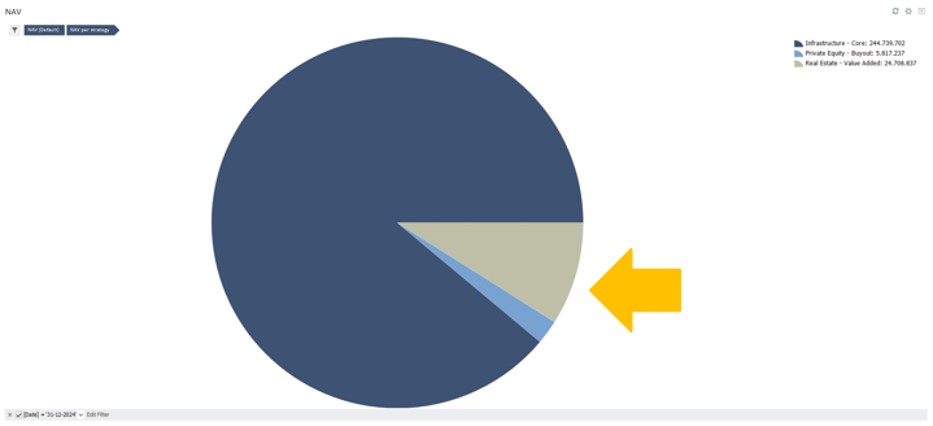

In this example assumptions for the return of infra core and real estate value added funds are changed. The standard assumptions give a composition of distributions of the NAV by end of 2024:

Changing the return expectations lead to a significant change in the distribution of NAV by end of 2024 which easily can be evaluated by running the analysis with the new assumptions.

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Cash-flow Forecasting for Illiquid Alternative Investment Funds

Release 24.04 - Alternative Investments

Ability to model inverted J-curve

Relevant for secondary fund-of-fund mainly as fund manager buys at discount. This functionality allows investors in illiquid alternative assets to refine their forecasts for strategy specific cashflow and interim performance patterns.

For many investors an important use case is mitigating their portfolio of primary funds’ J-curve and the associated accounting losses through adding secondary funds-of-funds.

The J-curve relates to the pattern the average fund shows from its investors’ perspective when it posts negative returns in its initial years and then its returns increase as the fund matures. The negative returns notably result from a fund’s underperforming and failing assets that are written off in their early days before the outperformers make their impact. Secondary buys, if at a discount, typically show an inverted J-curve, first showing a high internal rate of return (IRR) that, however, over time comes down again.

The functionality is not confined to secondary funds-of-funds but can be applied other strategies as well. For illustration, a VC fund’s typically more pronounced J-Curve is caused by the high number of initial write-offs; effectively, the fund managers are buying the portfolio at a premium to the assets’ fair value. This premium can now be set in the model.

Benefits

- Increases the investment coverage in ASTRA.

- Gives users a more accurate view on their future portfolio’s value creation development.

- Combining funds with different strategies helps users in constructing portfolios with targeted cashflow and valuation development characteristics.

- Enhances deterministic and stochastic forecasting models to handle fund manager value added through systematic discounts / premiums.

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Cash-flow Forecasting for Illiquid Alternative Investment Funds

Modelling Divestment plan for secondary sells

With this new functionality the user can simulate and assess the impact of selling a share in a fund that is currently in the portfolio at a given future date and price.

Benefits

- Ability to model the impact of a secondary sell on the investment strategy.

- Increased front office analytical capabilities to assess ‘what-if’

The Portfolio Strategy now supports adding a Divestment Plan. Users can ‘click' together several positions to be sold and specify date, share of commitment (between 0% and 100%) sold and amount that would be received. Subsequent forecasts are based on the new commitment (old commitment - draft commitment) and hence reduced proportionally based on the draft commitment.

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Cash-flow Forecasting for Illiquid Alternative Investment FundsRelease

24.01 - Alternative Investments

Private debt enhancement

Streamline operation for a decrease of commitment with no participation from the user.

When the global commitment amount for your loan facility decreases on a contract, you can choose not to participate in this decrease.

In this case, you can create events and transactions that ensure your non-participation, so that while the global commitment amount decreases, your participation rate in the global commitment increases proportionally to your existing positions, and your commitment remains unchanged.

Benefits

- Full automation of the process

- Easy to integrate with third parties’ information

- Remove heavy workaround

Process Decrease commitment with no participation

Subscription based licensing

Development partnerships

Sales module dependency

Private Debt

Dev.Partner: Private Debt - Phase I

Enhanced document processing for alternative fund decomposition

With this enhancement, you can import alternative investment performance reports and automatically create schedules of investments in a seamless end-to-end workflow that uses artificial intelligence to extract data and create Decomposition events in the Alternative Investments Manager.

Benefits

- Automated extraction of decomposition events from Schedule of Investments for Alternative Funds

Decomposition event extracted from Schedule of Investments

Subscription based licensing

N/A

Sales module dependency

Intelligent Document Processing

Peer Group Benchmarking

Evaluate the performance of close ended private market funds with peer group benchmarking. Benchmark individual funds or a group funds in the same vintage to pre-defined private market benchmarks.

A ranking is provided based on the quartiles and optionally top 5% and bottom 5% performers of the benchmark. Furthermore, it is possible to drill down and compare e.g., IRR of a specific fund to the IRR quartiles of the benchmark to assess if the fund is close to fall into the quartile above or below.

Benchmarking is available for IRR, TVPI, DPI and direct alpha.

The solution is provider agnostic and supports private market benchmarks from Preqin, Cambridge Associates, Burgiss etc. and enables the use of benchmarks from several providers simultaneously.

Benefits

- Enable provider agnostic peer group benchmarking

- Optimize workflows by having standard performance analytics, public market benchmarking and private market benchmarking the same place

- Enable flexible definitions of rankings including top 5% and/or bottom5% performers

Rankings for IRR and TVPI are shown based on the Private Capital – All benchmark for a portfolio of funds.

The TVPI per vintage for a portfolio of funds is shown next to the 25th, 50th and 75th percentile from the Private Capital – All benchmark. For e.g., the 2012-vintage, we can see that we are in 2nd quartile but close to being in the 3rd quartile.

Subscription based licensing

Alternative Investments Manager

Sales module dependency

N/A

Stress scenarios for illiquid alternative fund cashflows

Investments in illiquid alternative assets are long-term oriented. To deal with unexpected developments, investment managers need to assess what happens if certain scenarios materialize. Stress scenarios are an indispensable part of portfolio management to test the effects of changing conditions on the portfolio’s behavior. For the alternative investment funds such changing mainly manifest in changes of cashflow patterns which can now be assessed within the Alternatives Strategy module.

Benefits

- Enables users to assess how a portfolio of funds will respond to future changes in market conditions and to identify factors that imperil the investment strategy’s success.

- Enables users to produce more robust forecasts as stress scenarios can reflect a wider variation of possible futures and situations that have not necessarily occurred in the past.

- Allows users to flexibly combine several types of cashflow-related stresses like, for illustration, the acceleration of capital calls plus a delay of repayments plus an extension of fund lifetimes and define the groups of funds to which these combined stresses can be applied.

The Alternatives Strategy module allows users to generate liquidity and capital risk related KPIs, such as a portfolio’s Cashflow-at-Risk (i.e., the net of contributions and distributions) and how it develops over time:

Applying a stress scenario that assumes an acceleration of contributions results in a situation where an investor needs to pay out money earlier than expected and, as several contributions are compressed within a shorter time frame, also result in higher aggregate amounts that are called:

The Alternatives Strategy module allows users to look at this in more detail, separately for contributions and distributions and also assess the impact on the portfolio’s overall valuation:

This image shows a combination of various stresses: an accelerated contribution schedule where investors have to provide funding quicker than usual. Consistent with a stressed market environment are longer lifetime for funds as fund managers attempt to ‘ride out’ crises and wait for a better exit environment for their portfolio companies. Therefore also delayed realizations are part of this stress scenario. Consistent with these cashflow patterns is a portfolio valuation that achieves its peak significantly later:

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Cash-flow Forecasting for Illiquid Alternative Investment Funds

Release 23.10 - Alternative Investments

Private debt

Streamline operation for an increase of commitment with no participation from the client.

When the global commitment amount for your loan facility increases on a contract, you can choose not to participate in this increase.

In this case, you can create events and transactions that ensure your non-participation, so that while the global commitment amount increases, your participation rate in the global commitment decreases proportionally to your existing positions, and your commitment remains unchanged.

Benefits

- Full automation of the process

- Easy to integrate with third parties’ information

- Remove heavy workaround

Subscription based licensing

Development partnerships

Sales module dependency

Private Debt

Dev.Partner: Private Debt - Phase I

Auxiliary Job type for reconciliation of payment details on transactions created through the Intelligent Document Processing workflow

Build trust in the machine-learning-powered processing of private market transaction notices, by adding a reconciliation check for the payment details.

You can now automatically ensure alignment between payment details provided by fund managers/GPs on transaction notices with settlement defaults stored in SimCorp Dimension. This new auxiliary job type allows you to trigger such a check in your transaction STP workflow.

Users will be alerted to transactions with discrepancies for further investigation. Thereby, you can rest assured that reconciled transactions have the correct payment details for further processing (e.g., SWIFT message generation).

Benefits

- Ensure accuracy of payment details

- Increase STP rate for Alternatives transactions

- Prevent fraud and manual errors in payments processing

- Focus your back office users’ attention on exceptions

Subscription based licensing

Alternative Investments Manager

Sales module dependency

Intelligent Document Processing for Alternative Fund Transactions

Alternative Investments Manager

Release 23.07 - Alternative Investments

Colmore Integration – level 2 & 3

The Colmore level 2 & 3 integration enables automated creation of schedule of investments from fund performance reports (e.g. quarterly reports). This includes easy creation of new portfolio companies. For the portfolio companies, the solution also includes import of financial KPIs such as EBITDA.

The solution leverages SimCorp’s partnership with Colmore, a leading service provider in the private market space. The portfolio company and schedule of investment-data is retrieved from Colmore using dedicated APIs. The raw data is stored in SimCorp Dimension. Inside the Alternative Investment Manager, the status of the retrieval and import process can be monitored. Easy steps can be taken to resolve potential issues such as matching the fund between Colmore and SimCorp Dimension, when identifiers don’t match upfront.

Benefits:

- Enable automated import of schedule of investments including creation of portfolio company data

- Enable automated import of financial KPIs for portfolio companies

- Optimize workflows with overview of needed user interaction and easy steps to resolve potential issues

The schedule of investments is imported from the Colmore level 2-data and stored as a decomposition event in SimCorp Dimension. Portfolio companies are created with key information such as name, currency, geography and GICS-classification.

Subscription based licensing

Pilot

Sales module dependency

Alternative Investments Manager, Alternatives Fund Decomposition and Look-through