ESG

Release 26.01

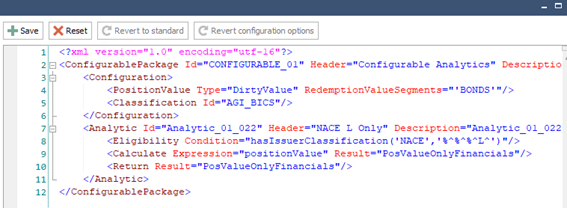

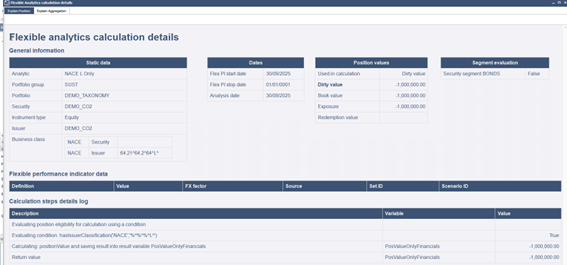

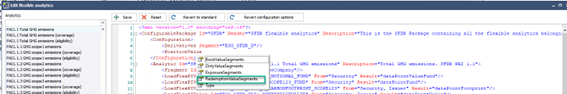

Support for check of Business Classification in Flexible Analytics Editor editor in “Condition” and “Eligibility” statements

Users can now define Flexible Analytics in the Editor which are based on either its Security’s or its Issuer’s Business Classification. The Business Classification criteria can be used in the “Condition” and/or “Eligibility” statement. For example, this enhancement allows the user to calculate a KPI for a specific NACE selection (e.g. financials) which is required in the NFRD omnibus regulation.

Benefits

- Enables users to define Flexible Analytics with additional requirements based on Security or Issuer Business Classification.

- The additional check can be used in either “Condition” or “Eligibility” statements in the Flexible Analytics Editor.

- NFRD Omnibus requires a differentiation of Financial and Non-Financials in certain KPIs. This is reflected via NACE Business Classification, which can now be used in the Flexible Analytics Editor.

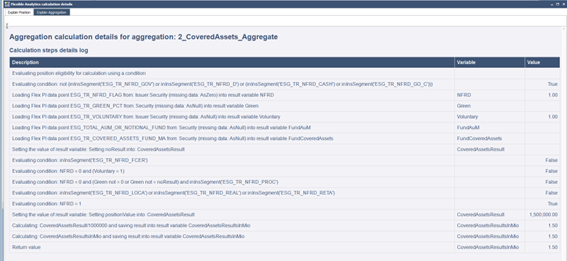

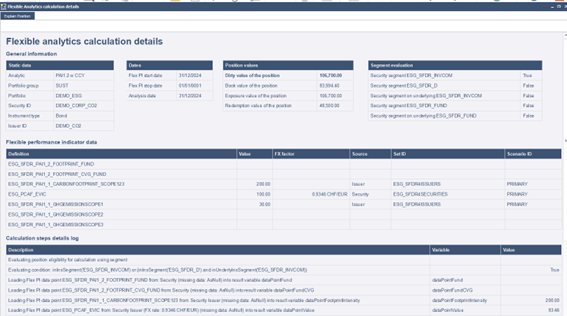

Explain Flexible Analytics of aggregate in Asset Manager

With 26.01 the user can easily validate Flexible Analytics aggregation result on a position level of in the Asset Manager. The “Calculation steps details log” is now also enabled on a position level for the aggregation result. That helps the user to follow the calculation logic stepwise and identify potential missing data points or configuration and thereby validate ESG figures calculated in SimCorp Dimension.

Offboarding of Flexible Analytics Packages

The offboarding of Flexible Analytics Packages allows the user to disable previously onboarded Flexible Analytics standard packages that are either not needed any longer (e.g. because a new regulation is substituting an old) or momentarily not required. This enables the user to continue using the Flexible Analytics Service even with some configurations from offboarded packages missing.

Benefits

- Users can streamline their Flexible Analytics by disabling Flexible Analytics packages that are no longer relevant, reducing clutter and focusing only on necessary regulatory requirements.

- It provides operational flexibility, allowing users to re-enable previously offboarded packages as business needs or regulatory requirements change.

- The service remains operational and effective even when certain (offboarded) package configurations are missing, ensuring uninterrupted analytics capabilities while adapting to evolving requirements.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

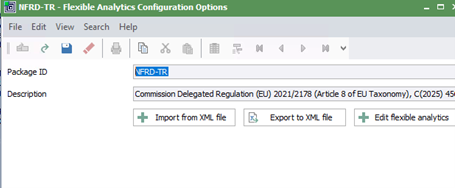

NFRD-TR (Omnibus) Disclosure Delegated Act Taxonomy Article 8 package available as Flexible Analytics

The new standard package “NFRD-TR” contains the pre-configured ESG analytics for the regulatory requirements set in the Commission Delegated Regulation (EU) 2021/2178 (Article 8 of EU Taxonomy), C(2025) 4568 from July 4 2025. It comprises 64 analytics for Annex X and 60 analytics for Annex IV with 12 breakdowns (of the other counterparties KPIs).

- Comply with most recent regulatory updates

- Consistent solution across packages using the Flexible Analytics Editor

- Easily adjustable for custom requirements using xml

Subscription based licensing

ESG Investing, NFRD-TR

Sales module dependency

ESG Investing, NFRD-TR

Browse the Release Portal

Release 25.10

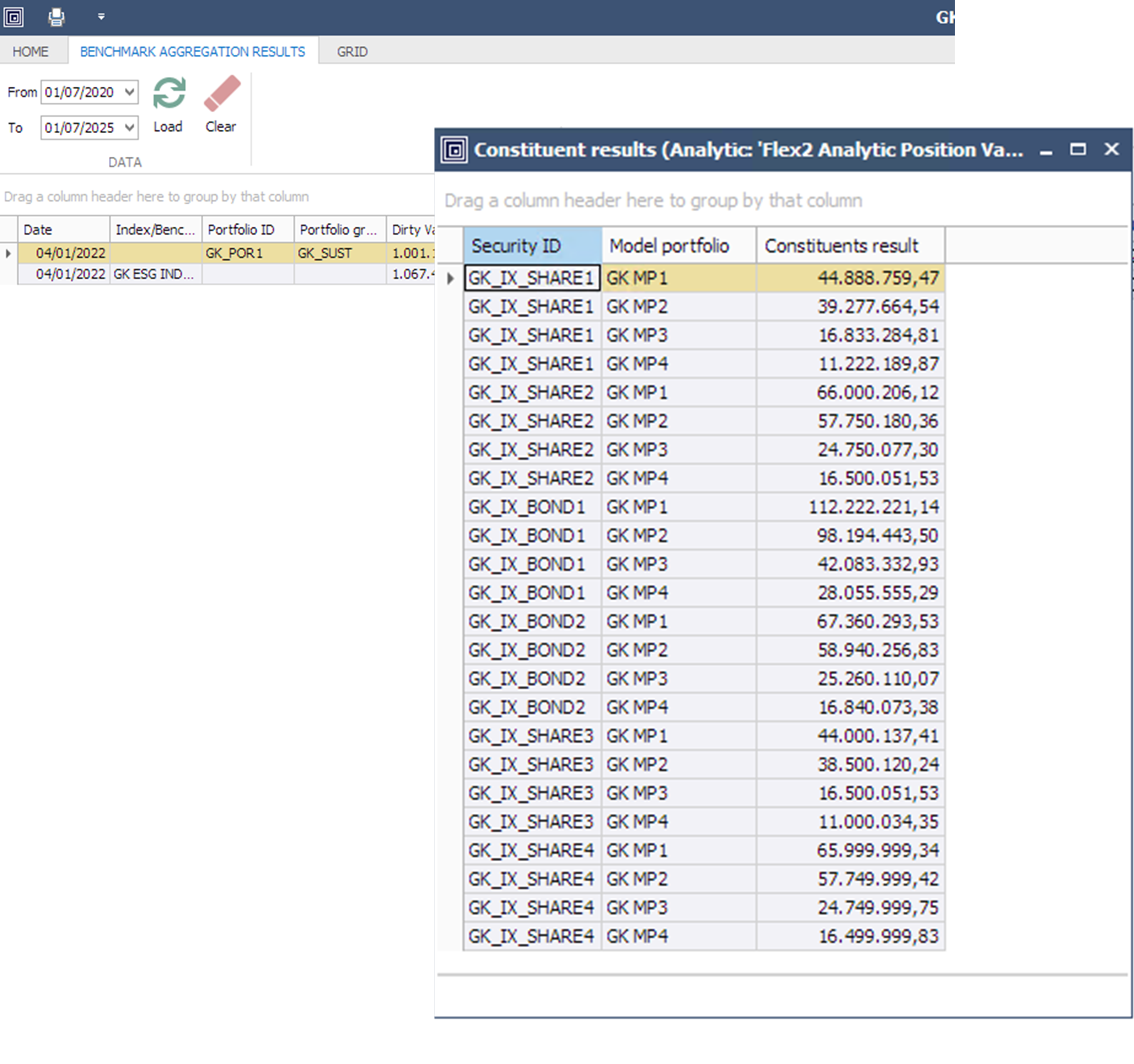

Benchmark aggregation calculation – save constituents’ ESG contribution to database and view both aggregated and position result in SCD

Users can now validate ESG results at the level of benchmark constituents. This enhancement provides transparency into how each constituent contributes to the overall FlexAnalytic, enabling more accurate reporting. Next to being able to extract the constituent and aggregated results, the user can now in SCD see both aggregated and constituent results in a results screen.

Benefits

- Enable granular validation of ESG metrics at the benchmark constituent level.

- Improve transparency and auditability of ESG results for compliance and reporting.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

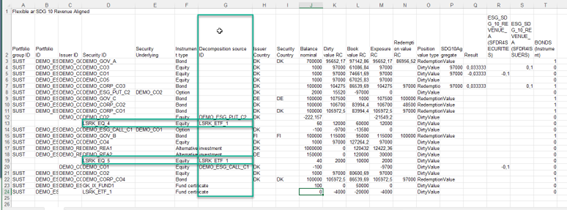

Redemption value as new Position Value

Flexible Analytics now supports Redemption Value as a Position Value option, enabling more accurate investment assessments in, for instance, SFDR reporting. For bond instruments, this enhancement ensures that the “current value of investment” reflects the book value of debt owed by the borrower, aligning with SFDR requirements. This allows users to correctly calculate the ratio of current value of investment to the investee company’s enterprise value, improving the precision and compliance of ESG disclosures.

Benefits

- Enable redemption value as position value for a defined set of instruments, including bonds.

- Improve accuracy of SFDR-related metrics by aligning with regulatory expectations.

- Support ESG reporting flows through the correct application of position value for bonds in investment calculations

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

![]()

Added support for FlexPI data with any currency in FlexAnalytics

Flexible analytics now fully supports automatic currency conversion for ESG metrics when the data point currency differs from the reporting currency. This ensures accurate and consistent results across multi-currency portfolios without manual intervention. Before, this was possible for UDKRs, now it is also possible for FlexAnalytics.

Benefits

- Enable seamless ESG analytics across currencies with automatic FX conversion.

- Save time and reduce errors by eliminating manual currency adjustments.

- Improve accuracy of ESG reporting in global investment contexts.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

![]()

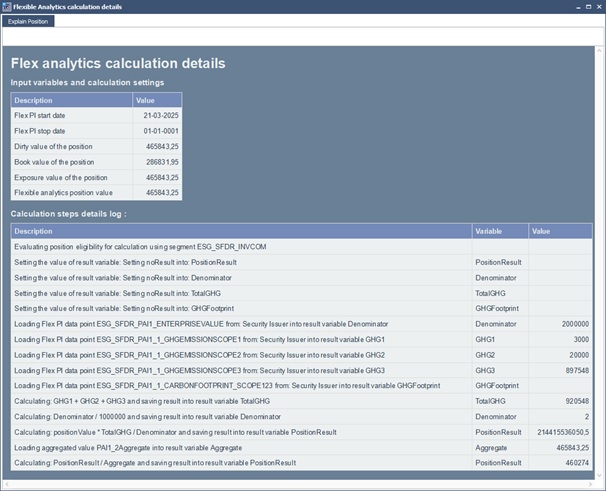

Improvements of the “Explain Flexible Analytics” in the Asset Manager

There are multiple enhancements to the “Explain Flexible Analytics” feature in 25.10 in the Asset Manager.

The Asset Manager’s “Explain Flexible Analytics” functionality now enables faster and more reliable validation of fund and benchmark constituents, and model portfolio positions. Enhancements to the .csv output provide meaningful static data information of the decomposed security ID of the fund, the benchmark constituent, and the model portfolio position. For decomposed fund certificates, their decomposition source is added as an additional column in the .csv file.

Further, “Flexible Analytics calculation details” in the Asset Manager is now more comprehensive and includes more validation data, like e.g. FlexPI data and FX rate, Segment evaluation, Flex PI start and stop dates.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

![]()

SDG (Sustainable Development Goals) package available as FlexAnalytics

The SDG standard package enables users to integrate 240 pre-configured ESG analytics and 20 configurable placeholders into their flexible analytics setup. This ensures consistency across SDG, SFDR, and NFRD-TR frameworks, reducing the need for manual configuration and improving time-to-value for ESG reporting.

Benefits

- Enable consistent ESG reporting across regulatory frameworks using a standardised analytics package.

- Save time by eliminating the need to manually configure SDG metrics.

- Optimise ESG onboarding with a scalable and centrally maintained analytics package.

Subscription based licensing

ESG Investing, SDG Alignment

Sales module dependency

ESG Investing, SDG Alignment

Release 25.07 ESG

Issuer-level netting treatment for long and short exposures

You can now ensure SFDR-compliant sustainability reporting by automatically netting long and short positions—including derivatives—at the issuer level, with a zero-floor logic that prevents negative exposures from distorting principal adverse impact (PAI) indicators.

This enhancement follows the latest Q&A guidance from the European Supervisory Authorities (ESAs), ensuring that all exposures linked to the same issuer are grouped and netted, and that any resulting negative total exposure is floored at zero. This treatment applies consistently across equities, debt instruments, and derivatives, using the issuer of the underlying for derivative positions.

While this logic is designed to support SFDR PAI calculations, it is also available for use in other analytics contexts where issuer-level netting is relevant. The setting is turned on by default in the SFDR PAI FlexAnalytics package, ensuring immediate compliance and consistency across sustainability reporting workflows.

Benefits

- Ensure compliance with SFDR by applying issuer-level netting and zero-floor logic for negative exposures.

- Avoid overstating adverse impacts from short or hedged positions by neutralizing net short exposures in PAI calculations.

- Extend analytical flexibility by applying the same netting logic to other use cases beyond SFDR, supporting broader ESG and risk analytics.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Store proxy ESG and fundamental data in FlexPI at business classification level

You can now store ESG and fundamental data in the Flexible Performance Indicator (FlexPI) repository at business classification levels 3, 4, and 5. This allows you to use proxy data for industry averages in Flexible Analytics—enabling analytics to fall back to sector-level values when data is missing at the security or issuer level.

For example, if emissions data is unavailable for a specific security and its issuer, the system can retrieve an industry average from the corresponding business classification, such as a NACE sector. This ensures broader data coverage and supports more consistent ESG and fundamental reporting across your portfolios.

Benefits

- Enable fallback logic for ESG and KPI data

Retrieve data from business classification levels when security or issuer-level data is missing, ensuring continuity in analytics. - Use proxy data for industry averages

Apply sector-level values (e.g., NACE) to fill data gaps, improving completeness and comparability in ESG and fundamental metrics.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

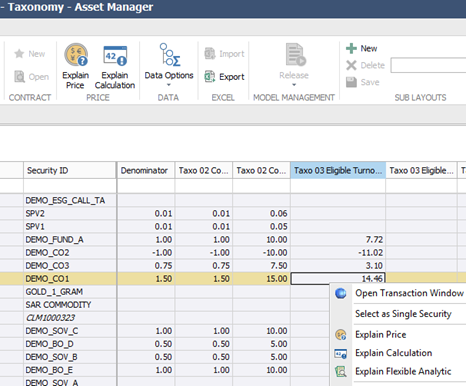

Enhanced Explain Flexible Analytic – Radical transparency

You can now fully trace how ESG and fundamental values are calculated in Flexible Analytics using the enhanced Explain ESG functionality. This feature brings radical transparency to your data—giving you a step-by-step breakdown of how each analytic value is derived, directly from the Asset Manager.

By right-clicking on any value and selecting Explain Flexible Analytic, you’ll see a detailed walkthrough of the entire calculation process—from data inputs and variable configurations to the final computed result. Whether you're working with standard or custom analytics, this enhancement helps you confidently validate and explain every number.

Think of it as having a developer sitting next to you, walking you through the logic behind the scenes — but without needing to read a single line of code.

Enhanced Explain Flexible Analytic.

Benefits

- Enable full traceability of ESG and fundamental values

Understand exactly how each analytic is calculated, from raw data to final result. - Build trust and confidence in your analytics

Easily validate ESG metrics and explain them to stakeholders, auditors, or clients. - Support both standard and custom analytics

Get transparency across all analytic types—no matter how tailored your setup is.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Coverage and eligibility analytics for SFDR-PAI

To support more transparent and structured ESG reporting — including fund-level disclosures aligned with the European ESG Template (EET) — each SFDR Principal Adverse Impact (PAI) analytic now comes with two optional companion analytics: one for eligibility and one for coverage. These analytics help you assess how much of your portfolio is in scope for a given PAI, and how much of that scope is actually covered by data.

While both coverage and eligibility are voluntary, they are valuable tools for understanding data completeness and improving the quality of your disclosures. The coverage logic now aligns with the methodology defined in the EET, which is widely adopted across the industry.

For example, in a portfolio of 100 equally weighted positions:

- 50 positions are eligible for a specific PAI

- 20 of those eligible positions have valid data

The new coverage calculation is:

Coverage = Positions with data / Total portfolio value = 20 / 100 = 20%

This differs from the previous logic, which would have calculated:

Coverage = Positions with data / Eligible positions = 20 / 50 = 40%

If needed, the calculation logic can be adjusted via configuration to reflect your preferred methodology.

Benefits

- Gain deeper insight into ESG data quality

Use out-of-the-box eligibility and coverage analytics to assess how much of your portfolio is in scope and how much is backed by actual data. - Support fund-level ESG reporting aligned with the EE

Meet industry expectations for standardized, transparent disclosures across portfolios.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

SFDR-TR as Standard Package within the Configurable Flexible Analytics framework

Streamlined integration with Standard Package Configuration

With version 25.07, the SFDR-TR standard package is now available as part of the Configurable Flexible Analytics (FlexAnalytics) framework. This package supports periodic reporting for Articles 8 and 9 products under the SFDR regulation, based on the KPI definitions in Annexes IV and V of the SFDR RTS. Delivered as part of the SimCorp Dimension release, the standard package enables efficient onboarding and ensures consistency across updates. As with other standard packages, it includes both preconfigured and freely configurable analytics, allowing for client-specific customization where needed.

Comprehensive EU Taxonomy KPI coverage

The package includes a broad set of EU Taxonomy-aligned KPIs, covering:

- Investment-level breakdowns for Articles 8 and 9 products, including sustainable, environmental, and social dimensions.

- Revenue, CapEx, and OpEx alignment metrics across all objectives, with or without sovereign exposure.

- Detailed activity classifications, including enabling and transitional activities, with numerator-level granularity.

- Revenue alignment KPIs for each of the six environmental objectives under the EU Taxonomy.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

SFDR

Release 25.04 ESG

Flexible Analytics integration into Benchmark Aggregation Calculation

Achieve comprehensive ESG Reporting on benchmark level

With version 25.04, you can now leverage flexible analytics for ESG reporting on benchmark level. This enhancement expands ESG metrics beyond User Defined Key Ratios (UDKR)-based metrics, ensuring that benchmark aggregations are also available for flexible analytics.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

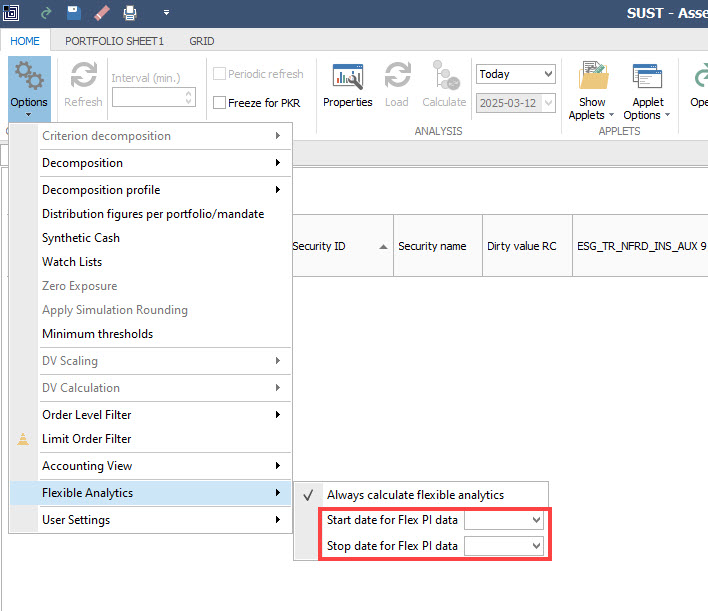

Configure Earliest Cut-Off Date for Using ESG Data

Ensure accurate ESG Reporting with configurable cut-off dates

With version 25.04, you can now configure the earliest cut-off date for fetching FlexPI data used in FlexAnalytics calculations. This enhancement ensures your ESG reports are based on the most relevant and current information, helping you avoid outdated data.

Flexible configuration for cut-off dates

You can configure the cut-off dates for FlexPI data in several places:

- In a batch job setup where the Batch task field is set to Aggregation Calculation - Calculate or Benchmark Aggregation Calculation - Calculate.

- In Asset Manager, under Options > Flex Analytics.

- In Compliance Manager in the Compliance Configuration window.

Asset Manager Start date and Stop date

To configure the dates:

To set the earliest cut-off date, enter a date or reference date (only in batch jobs) in the Stop date for Flex PI data field. The default setting is the earliest possible date, meaning all applicable FlexPI data is used regardless of age. When using a reference date, it is relative to the analysis date.

To set the latest cut-off date, previously known as "Max. date for Flex PI data," enter a date or reference date in the Start date for Flex PI data field. The default setting remains the analysis date, as before.

These enhancements provide comprehensive and accurate ESG reporting capabilities, ensuring compliance with regulatory requirements and supporting your sustainability goals.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Added Re-Usable Fragments in Configurable Flexible Analytics

Enhance efficiency and consistency with re-usable fragments

With version 25.04, you can now insert re-usable fragments in your configurable flexible analytics setups. This enhancement makes your analytics setups more efficient, consistent, and easier to maintain. By encapsulating recurring code in a fragment, you can re-use this piece of code wherever it is required. If the configuration of this code changes, you only need to edit it in a single place, streamlining maintenance.

Flexible fragment configuration

Fragment tags can include Set, CalculationCases, Calculate, and LoadFlexPiValue. However, they cannot contain Eligibility statements, as one package can contain several fragments. This flexibility allows you to create modular and reusable components within your analytics setups.

Simple integration of fragments

To insert a fragment into a flexible analytics definition, reference it by its unique ID attribute at the package level in analytics and aggregations. This straightforward integration ensures that analytics setups remain organized and maintainable.

These enhancements make analytics processes more efficient and consistent, supporting overall data management and reporting goals.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

SFDR (RTS1.0 and draft RTS1.5) as Standard Package within the Configurable Flexible Analytics framework

Added SFDR standard package for configurable flexible analytics

Efficient onboarding with standard package configuration

With version 25.04, you can now integrate SFDR analytics into a standard package of configurable flexible analytics. The standard package configuration is part of the SimCorp Dimension release, ensuring fast and seamless onboarding. Updated standard package configurations can be released with SimCorp Dimension updates, keeping your analytics current and compliant. Additionally, a standard package can contain analytics without configuration, known as Configurable analytic SFDRAnalytic, which are freely configurable.

Comprehensive SFDR analytics

The FlexAnalytics solution includes the 11 Principal Adverse Impacts (PAIs) present in SFDR RTS1.5 (in draft state from December 2023). Some data providers deliver precalculated intensities (e.g., Carbon footprint as a single data point), while others deliver the individual data points required to calculate intensities (e.g., Carbon footprint as four data points: GHG Scope 1, GHG Scope 2, GHG Scope 3, EVIC). We support both versions as standard, with a fallback from the first option to the second option.

Subscription based licensing

ESG Investing, SFDR-PAI

Sales module dependency

ESG Investing, SFDR-PAI

Release 25.01 ESG

Extended Configurable Analytics functionality to support standard packages of analytics

- Achieve greater flexibility with standard package configurations: Starting with version 25.01, standard analytics packages are now delivered through the configurable FlexAnalytics framework. This enhancement allows you to examine and adjust the calculation logic as needed.

- Effortlessly verify analytic status: Quickly determine the status of each analytic using new filter options. Whether identifying modified analytics, ensuring compliance with the latest standards, or finding analytics ready for safe upgrades, these filters provide clarity and control.

- Country-level data integration: Fetch country-level data seamlessly within Configurable FlexAnalytics. The From attribute now supports multiple levels, including SecurityCountry and IssuerCountry, allowing you to configure data retrieval precisely to your needs.

- Streamlined ESG reporting with aggregations: Leverage new aggregation capabilities to calculate and consolidate values for ESG reporting. This feature supports comprehensive analytics, such as denominators in the SFDR context, enhancing both reporting accuracy and efficiency.

- Advanced aggregation by issuer or country: Aggregate your analytics by issuer, issuer country, or security country, and view the consolidated data in Asset Manager. Configurable via the GrandRuleType attribute, this functionality groups and presents analytics meaningfully, supporting reporting under SFDR PAI 1.16.

These enhancements are designed to provide you with more control, precision, and efficiency in your ESG analytics processes.

Revert to standard functionality available in the FlexAnalytics editor.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Out-of-the box support for ESG calculations at derivative level

Starting with version 25.01, our configurable flexible analytics for ESG reporting now support derivatives. This expanded scope ensures comprehensive entity-level disclosure by converting derivatives into equivalent positions in their underlying assets, meeting SFDR reporting requirements and aligning with other ESG regulations.

In practice, for derivatives, Exposure will be used as the position value, with ESG data retrieved from the underlying assets. To enable this, the file format definition for configurable flexible analytics has been extended to include a Configuration tag, which allows for a derivatives segment declaration of eligible instruments.

Derivatives support in FlexAnalytics

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Release 24.10 ESG

Embedded editor for Configurable Analytics in the new EBOR engine

New embedded editor for configurable analytics

With the new embedded editor, you can now enhance your configurable EBOR analytics workflow by seamlessly editing, configuring and unconfiguring, and exporting analytics. This feature provides instant feedback, showing you errors as they occur, ensuring data accuracy. Connected to the database, it allows you to select only the relevant Flexible Performance Indicator setups (definitions, sets, scenarios) available in your installation. The auto-save feature ensures you do not lose valuable work when scrolling through and editing multiple analytics, and the reset button allows you to unconfigure analytics efficiently. This enhancement streamlines your configurable analytics editing process, making it more efficient and user-friendly.

SimCorp Dimension embedded editor for configurable analytics

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

New milestone for our powerful EBOR engine

Clients can now set up compliance rules based on EBOR analytics. The well-known outcomes enabled by the Compliance Manager are now achievable for ESG calculations. For example, with the faster EBOR engine now integrated into Compliance Manager, users can ensure compliance with internal ESG policies even before a trade happens, enhancing overall efficiency and reliability. This marks an important milestone for the EBOR engine, which is now fully integrated into the front office portfolio flow, namely into the Asset Manager and into Compliance Manager.

This enhancement allows users to create pre- and post-trade rules based on the new EBOR analytics. The analytics, available as attributes once a package is onboarded, can be used in the context of Holdings rule type basis. Additionally, the introduction of a no result column for each EBOR analytic shows a Yes when the analytic is zero due to missing data, increasing transparency and distinguishing between a zero from actual data points and a zero from missing data.

Distinguish between a 0 that comes from a data point and a 0 that arises as a result of missing data.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Release 24.07 ESG

![]()

Onboard any ESG KPI in the powerful EBOR engine

Achieve More with Custom ESG KPIs

We are transforming our ESG Book of Records (EBOR) with a new powerful engine that offers accelerated performance with massive workloads. With 24.07 you can now onboard your own custom ESG KPIs within the new EBOR engine. This enhancement allows you not only to leverage the accelerated performance of the new engine with your own KPIs, but it also makes it easier than ever to configure and onboard new ESG KPIs. This is possible with the newly introduced Domain Specific Language (DSL) that allows you to specify the ESG KPI business logic and its methods in high level business terms. The DSL encapsulates several key methods, the most important being:

Enhanced Calculation Logic

Our enhanced calculation logic supports four basic math operations, parentheses, and allows the use of as many FlexPI data points as you want along with constants.

Eligibility Specification

You can now simply specify the holding or instrument segment for which the analytic should apply.

Simplified Fall-Back Mechanism

We’ve simplified the fall-back mechanism. Just specify “Security, Issuer” or the other way around, and the engine does the work.

Handling Missing Data

You can choose to treat missing FlexPI data as null, which results in the whole analytic becoming null and showing null in consuming applications such as the Asset Manager, or to treat missing data as zero and effectively turn any null into 0 and use it as such.

Position Aggregation

You can aggregate your analytic results across positions in two ways: a) simple summation to add up all results or b) weighted average based on position value.

Benefits

- High-Level Domain Specific Language (DSL) that simplifies business logic definition, letting you concentrate on goals while we handle the complex calculations.

- Import your analytics with just a click and have them instantly available system-wide

- Your own KPIs now with accelerated performance over massive workloads

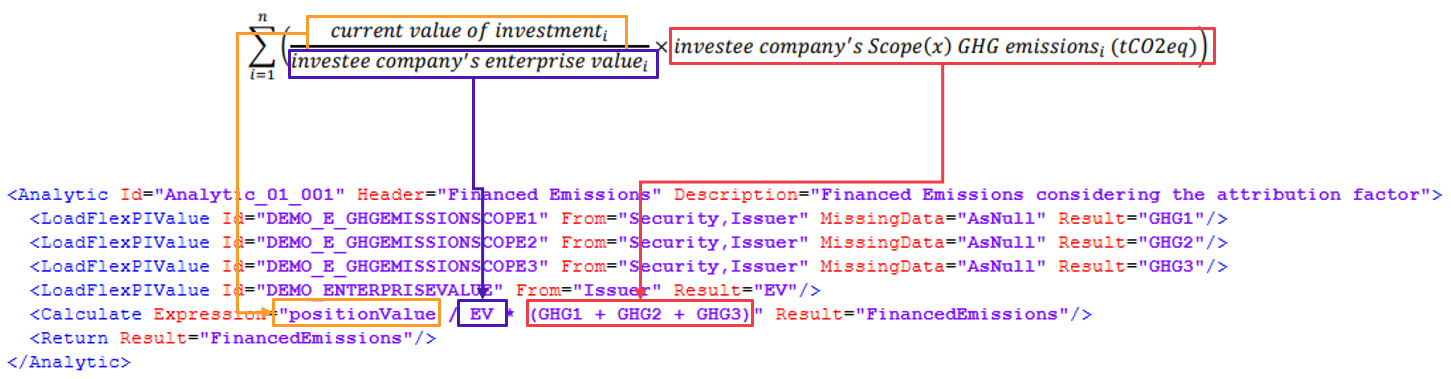

Images / Examples

For example, this is how one of the more complex analytics can look like. This allows you to calculate financed emissions taking into account your ownership fraction (or attribution factor).

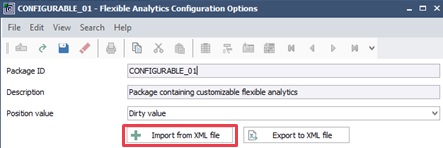

Once you have configured the analytics, simply import it by clicking on “Import from XML file” in the “Flexible Analytics Configuration Options” windows.

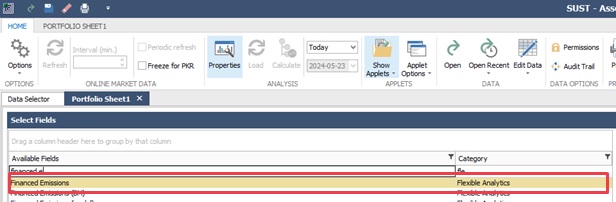

And then it is instantly available in the Asset Manager (screenshot below) or Aggregation Calculation for the reporting flow.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Release 24.04 ESG

Modifying ESG reference date for ex-post, ex-ante, and custom views

Any ESG analytics is based on a combination of ESG data and position information. The ESG Book of Record carefully selects the ESG data relevant for the analysis date based on the business logic encoded for the specific ESG data point and combines this data point with the position information at the same analysis date. It is now possible to modify the date from which the ESG data is derived. This gives an extra dimension of flexibility in the views and results that are delivered by the EBOR.

The flexibility is available for ESG analytics created via the Flexible Analytics Calculation Service which was made available with SimCorp Dimension release version 24.01.

To modify the reference date of the ESG date point in the Asset Manager, set the relative or absolute date in the “options” menu as indicated in the figure below. Similarly, fields are available in the middle office calculation manager and relevant batch jobs.

Benefits

- Test ESG compliance rules on portfolio with anticipated future ESG data, i.e., ESG data with time stamps on a future date.

- Create ex-post ESG views and reports for portfolios with ESG data that were not known throughout the report period.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Flexible Analytics Configuration Options: Your Key to Unleashing the Power of Customization

Introducing NFRD – Flexible Analytics Configuration Options: Your Key to Unleashing the Power of Customization

In the ever-evolving landscape of EU ESG regulations, interpretations vary as to how should one calculate the KPIs under the Disclosures Delegated Act (DDA) that companies in scope of the Non-Financial Reporting Directive (NFRD) need to report on. Influenced by auditors, data providers, and competent national authorities within the EU, these variations can be a challenge. But what if you could navigate this complexity with ease?

Enter our new feature, the NFRD – Flexible Analytics Configuration Options. This powerful tool encapsulates all variations of NFRD analytics calculations, offering them as user-friendly, out-of-the-box configuration options.

With this feature, you can effortlessly customize:

- The position value used for calculations, previously available under the Flexible Analytics Onboarding window.

- The treatment of certain positions, whether to mutually exclude them or count them under multiple KPIs.

- The handling of missing data under certain KPIs.

- The calculation of the “eligible, not aligned” KPIs in Annex IV and Annex X of the Disclosure Delegated Act.

- The management of short positions.

Benefits

- Simplicity: Switch between different types of calculations with ease. This one-off exercise applies to all analytics in the package.

- Future-Proof: Stay ahead of the curve. Anticipate changes in vendors’ methodology, auditors’ interpretation, and regulators’ guidance.

- Embrace the future of NFRD analytics. Experience the power of customization like never before with NFRD – Flexible Analytics Configuration Options.

Various configuration options under the NFRD package. If not changed, these are default options.

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Release 24.01 - ESG

ESG enhancements

Faster, stronger, better EBOR

The number of relevant ESG analytics as well as the complexity of some of these ESG analytics, continue to grow. For this reason, we introduce a calculation service dedicated to ESG, which makes it possible to swiftly handle very large ESG calculations and enables a wider set of analytics.

When you activate the calculation service, a significantly greater number of ESG KPIs can be integrated in the online front office environment without additional hardware requirements. The reporting business processes for ESG are similarly accelerated with shorter calculation times and reduced memory footprint as a result. Even faster reporting processes is enabled via optional, automated scale-out to multiple calculation servers.

With the ESG calculation server, more data from IBOR and ABOR is immediately accessible, which enables more complex ESG analytics. First benefit is that SimCorp’s solutions for EU Taxonomy article 8 reporting, sometimes referred to as NFRD-TR, are updated to be based on either market values or book values, where the latter is preferred in some regional jurisdictions of EU.

The new calculation service is rolled out in phases. The first iteration includes support for the NFRD-TR solutions. The next iterations will expand the usage to other standard solutions as well as free-form custom ESG KPIs that users define based on their own proprietary standards.

Benefits

- Decrease hardware requirements with activation of calculation service

- Significantly reduce calculation times for reporting needs

- Enable use of book value scaling in Taxonomy article 8 solution with SimCorp’s standard solution

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing

Release 23.10 - ESG

ESG reporting for underlying investments in Private market funds

As a portfolio manager or ESG analyst working in the Asset Manager, you can already interact with ESG analytics and ESG results of individual companies in your private market funds. This is enabled by the look-through, drill down, and filtering capabilities of the Asset Manager.

Similar capabilities have now been added in the reporting and data distribution flow. In the Middle Office Calculation Manager, you can now apply filtering and look-through of private market funds in combination with other asset classes. This completes the cycle in the operational value chain and delivers a fully cross-asset IBOR / EBOR / ABOR architecture. It gives you ESG results at the most granular level, delivered into your data warehouse for further distribution in dashboards and/or reports.

Benefits

- Monitor ESG contributions of underlying investments in your private market funds

- Build comprehensive views on ESG topics across liquid and illiquid investment types

Subscription based licensing

ESG Investing

Sales module dependency

ESG Investing